Carlos Barquero | Second | Getty Pictures

Inventory market volatility and speak about a attainable recession might have folks anxious about investing.

Nevertheless, that should not dissuade anybody from making an attempt to construct wealth, whether or not you’re simply beginning out in your profession, are middle-aged or are nearing retirement.

“We won’t predict the long run, however by considerate spending and saving all through your lifespan, you’ll be able to create monetary peace and resiliency for regardless of the world and markets throw your means,” stated licensed monetary planner Carolyn McClanahan, an M.D. and founder and director of monetary planning at Life Planning Companions in Jacksonville, Florida.

After all, the way you go about constructing wealth is determined by your age. Here’s a decade-by-decade information to rising your cash.

Beginning out in your 20s

The very first thing to do is be sure you have sufficient money stashed away for an emergency. In case your job is safe, set a financial savings objective of three to 6 months’ value of bills. Whether it is insecure, reminiscent of a commission-based gross sales job, attempt for six to 12 months, stated McClanahan, a member of CNBC’s Advisor Council.

You also needs to begin planning for retirement. In case your employer has a 401(okay) plan and provides a match, contribute sufficient to get that match.

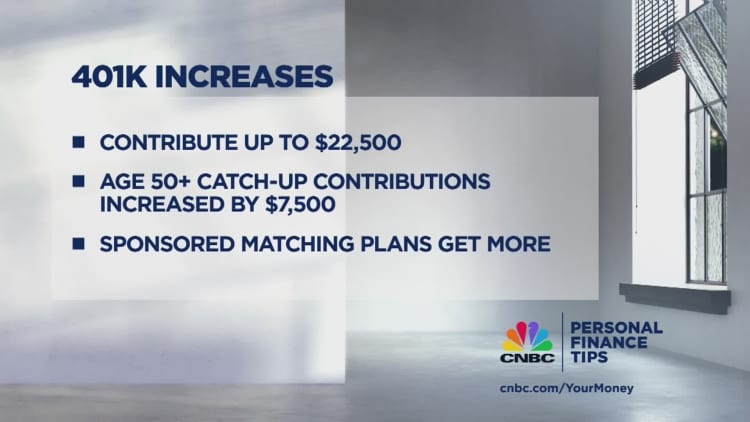

After that, open a Roth particular person retirement account, in case your revenue qualifies, McClanahan stated. You possibly can contribute a most of $6,500 in 2023. Then, when you nonetheless have cash to take a position after maxing out your Roth, contribute extra to your 401(okay) plan, she stated. In 2023, you’ll be able to put as a lot as $22,500 into the account.

On the subject of the stability of your portfolio, you’ll be able to have extra equities than fastened revenue since you’ve got extra time to get well from any down markets.

As well as, be sure you are insured appropriately, particularly with auto and incapacity insurance coverage, since one accident or well being concern might wipe out any financial savings you will have.

That is additionally a superb time to tackle a aspect hustle, stated Winnie Solar, co-founder and managing director of Solar Group Wealth Companions, primarily based in Irvine, California, and a member of CNBC’s Advisor Council.

“It is probably not producing a number of revenue, however it’s one thing they’ll create extra revenue from,” she stated.

In your 30s

As your profession grows and you start to earn the next wage, do not fall sufferer to the “way of life creep” and begin spending that newfound cash, warned CFP Matt Aaron, founding father of Washington, D.C.-based Lux Wealth Planning, an affiliate of Northwestern Mutual.

As an alternative, put that more money into your 401(okay) plan.

The rule of thumb is to place apart about 10% of your revenue, when you begin younger, however a monetary skilled can assist you’re employed out the numbers, he stated.

After you max out these contributions, begin investing exterior of your retirement account. Your portfolio ought to be diversified, with a mixture of shares and bonds.

You may additionally be interested by shopping for a home, getting married or having kids.

CFP Elaine King strongly recommends contemplating a house buy in your 30s. It is OK to begin small, she stated.

“It would not should be a giant home, simply one thing that in your future could be your rental revenue to diversify your property,” stated King, founding father of Household and Cash Issues in North Miami, Florida.

While you begin saving for these occasions, do not put money into shares — until your time horizon is longer than 5 years, McClanahan suggested.

As an alternative, she recommends a cash market account. Today, cash market fund charges have soared because the U.S. Federal Reserve hiked rates of interest. The typical yield on Crane Information’s listing of the 100 largest taxable cash funds is 4.62%. Equally, certificates of deposits, or CDs, have additionally seen their rates of interest rise.

If anybody is counting in your revenue, reminiscent of a partner or little one, it is also time to purchase life insurance coverage. For these with children, you could need to begin placing cash apart for school.

The busy 40s

Maskot | Maskot | Getty Pictures

You could now be in your peak incomes years and might also be elevating kids.

If attainable, attempt to begin a university financial savings account if you have not completed so already. If you cannot afford to, do not divert financial savings out of your retirement account.

“You possibly can borrow for school, however you’ll be able to’t borrow for retirement,” McClanahan stated.

For individuals who have yet saving for retirement but, setting apart 15% to twenty% of your revenue is taken into account a common rule of thumb at this age, Aaron stated.

You possibly can borrow for school, however you’ll be able to’t borrow for retirement.

Carolyn McClanahan

director of monetary planning at Life Planning Companions

You may additionally have getting old mother and father, so be sure you test on their monetary planning, McClanahan stated. If they are not ready, it’s one other monetary obligation which may be immediately thrown in your lap.

Solar stated she’s had many purchasers of their 40s begin to inquire about long-term care, with Covid pushing care considerations to the forefront. Conventional long-term care insurance coverage is pricey, however there are different insurance policies which are a hybrid — combining life insurance coverage and long-term care protection.

“It’s actually determining how a lot you’ll be able to afford, and if you cannot afford it proper now, a minimum of have the dialogue so you are ready,” Solar stated. “You’ll have to self-insure, or search for it by way of work.”

Getting critical in your 50s

Retirement is probably a decade away, so it is time to get critical about how a lot you’re really spending, and whether or not you’re on monitor to save lots of sufficient to help you all through your life, McClanahan stated.

When you hit 50, you too can set extra apart into your 401(okay) or IRA with so-called catch-up contributions. In 2023, the restrict is $7,500 for 401(okay) plans and $1,000 for IRAs.

In case you do not use a monetary planner, a minimum of get an hourly one to find out in case you are on monitor to help your way of life in retirement, McClanahan really useful.

Assess your property and ensure your portfolio is balanced to your wants. As you method retirement age, consultants sometimes advocate lowering dangerous property, reminiscent of shares, and rising fastened revenue, reminiscent of bonds.

Nevertheless, it is necessary to take care of inventory publicity because it provides you a larger return, Aaron stated.

In your 60s and past

At this level, that you must have a retirement distribution technique. Meaning understanding the completely different revenue streams you may have coming in.

“We have to construct an funding technique primarily based on a correct asset allocation, taking up solely as a lot danger that’s wanted for the revenue you require and your legacy targets,” Aaron stated.