WASHINGTON — China, beneath rising stress from high worldwide policymakers, appeared to point this week that it is able to make concessions that will unlock a worldwide effort to restructure lots of of billions of {dollars} of debt owed by poor nations.

China has lent greater than $500 billion to growing nations via its lending program, making it one of many world’s largest collectors. A lot of these nations, together with a number of in Africa, have struggled economically within the wake of the pandemic and face the opportunity of defaulting on their debt funds. Their issues have been compounded by rising rates of interest and disruptions to provides of meals and vitality because of Russia’s battle in Ukraine.

The US, together with different Western nations, has been urgent China to permit a few of these nations to restructure their debt and cut back the quantity that they owe. However for greater than two years, China has insisted that different collectors and multilateral lenders soak up monetary losses as a part of any restructuring, bogging down a crucial mortgage aid course of and threatening to push thousands and thousands of individuals in growing nations deeper into poverty.

A breakthrough would supply an financial lifeline to susceptible nations at a time of sluggish progress and unsure monetary stability, and it might sign a renewed curiosity from China in financial diplomacy.

Economists and growth consultants are watching fastidiously to find out if China is critical about easing the mortgage forgiveness logjam and if its discuss can be adopted by motion. By some calculations, the world’s poor nations owe round $200 billion to rich nations, multilateral growth banks and personal collectors. Leaders of the world’s superior economies have been grappling in current months with methods to avert monetary crises in teetering markets akin to Zambia, Sri Lanka and Ghana.

Africa’s non-public and public exterior debt has elevated greater than fivefold during the last 20 years to about $700 billion and Chinese language lenders account for 12 p.c of that complete, based on Chatham Home, the London coverage institute. Researchers for the Debt Aid for Inexperienced and Inclusive Restoration Mission estimated in a current report that 61 rising market and growing economies have been going through debt misery, and that greater than $800 billion in debt have to be restructured.

“China is going through rising stress from each quarter, together with from different rising market economies, to play a extra constructive function within the negotiations over debt restructuring,” stated Eswar Prasad, a former head of the Worldwide Financial Fund’s China division, who stated China’s intransigence had left it “more and more remoted.”

There have been indications this week that China was ready to finish that isolation as high financial officers from world wide convened on the spring conferences of the I.M.F. and World Financial institution. Members expressed optimism that representatives from Beijing seemed to be able to again off its insistence that multilateral lenders such because the World Financial institution, which supplies low-interest loans and grants to poor nations, settle for losses within the debt restructuring.

“My sense from the present context is we’re shifting on to new steps,” David Malpass, the departing World Financial institution president, stated at a information convention on Thursday, pointing to “progress on equal burden sharing.”

Extra on China

- Sodium Batteries: China is positioning itself to command the following massive innovation in rechargeable batteries: changing lithium with sodium, a far cheaper and extra considerable materials.

- Ditching Status Jobs: Younger folks within the nation are more and more buying and selling high-pressure, white-collar jobs for guide labor. They are saying it’s well worth the monetary sacrifice.

- Tourism: Regardless of loosened Covid restrictions and visa guidelines, the variety of flights into China remains to be a small fraction of what it was earlier than the pandemic. That is partly fueled by geopolitical tensions.

- Prolonged Sentences: Xu Zhiyong and Ding Jiaxi, two human rights activists, have been detained after organizing a small gathering to debate human rights. The size of their sentences — 14 and 12 years in jail respectively — level to Beijing’s intolerance of dissent.

Kristalina Georgieva, the I.M.F.’s managing director, stated she was “very inspired” {that a} “widespread understanding” had been reached that might speed up aid for nations akin to Zambia, Ghana, Ethiopia and Sri Lanka.

“I at all times say the proof of the pudding is within the consuming,” Ms. Georgieva stated.

To restructure a rustic’s debt, collectors usually should conform to a mix of decreasing the rate of interest on the mortgage, extending the length of the mortgage or writing off some of what’s owed. China, which has confronted an array of home financial challenges during the last three years, has been reluctant to take losses on debt and has pushed for different lenders, such because the World Financial institution, to incur losses.

The urgency for a decision was palpable amongst nations which can be most in want of aid. Zambia defaulted in 2020 and has been making an attempt to restructure $8.4 billion that it owes via a program established by the Group of 20 nations. It owes about $6 billion to Chinese language lenders, and its complete debt to overseas lenders is approaching $20 billion.

“Zambia urgently wants debt aid,” Situmbeko Musokotwane, Zambia’s finance minister, advised The New York Instances. “Delay on debt restructuring places our forex beneath stress, excludes Zambia from capital markets and makes it troublesome to draw much-needed overseas direct funding.”

Ghana appealed to the Group of 20 nations this 12 months for debt aid via a fledgling program often called the Frequent Framework after securing preliminary approval for a $3 billion mortgage from the I.M.F. That cash is contingent on Ghana’s receiving assurances that it may well restructure the roughly $30 billion that it owes to overseas lenders. Officers from Ghana have been assembly with their Chinese language counterparts about restructuring the $2 billion that it owes China.

On Friday, Ghana’s finance minister, Ken Ofori-Atta, lamented that 33 African nations have been saddled with curiosity funds that approached or exceeded what their governments spent on well being and schooling and expressed disappointment that superior economies had been gradual to behave.

“Actually, it’s disheartening to observe Africa wrestle on this method, particularly contemplating the potential lack of productiveness over the following decade ought to African economies buckle beneath the load of suffocating money owed,” Mr. Ofori-Atta stated at an Atlantic Council occasion on Friday.

However it stays unsure how far China is keen to go.

Brad Setser, a senior fellow on the Council on Overseas Relations, stated that it was not clear what monetary phrases Beijing would settle for when restructuring debt however that it seemed to be taking a “constructive step” that will take away “a financially unwarranted roadblock to any progress.”

However given the grinding tempo of the talks, massive traders in rising markets should not relying on fast resolutions.

“We’re beginning to see tokens of flexibility from China on their stance in sovereign debt restructuring, however complexities abound,” stated Yacov Arnopolin, rising markets portfolio supervisor at PIMCO. “Close to time period, we don’t anticipate a clear-cut resolution on China’s willingness to take losses.”

China’s reluctance has been one other supply of stress with america, which has expressed concern that Beijing’s onerous lending phrases and refusal to renegotiate have amplified the monetary issues that growing nations are going through. Treasury Secretary Janet L. Yellen stated this week that she would proceed to press her Chinese language counterparts to enhance the restructuring course of however that she was inspired that China had not too long ago expressed a willingness to assist Sri Lanka restructure its debt.

Individuals acquainted with Chinese language financial policymaking stated home politics had made it onerous for China to make troublesome choices final autumn and over the winter about accepting potential losses on its loans.

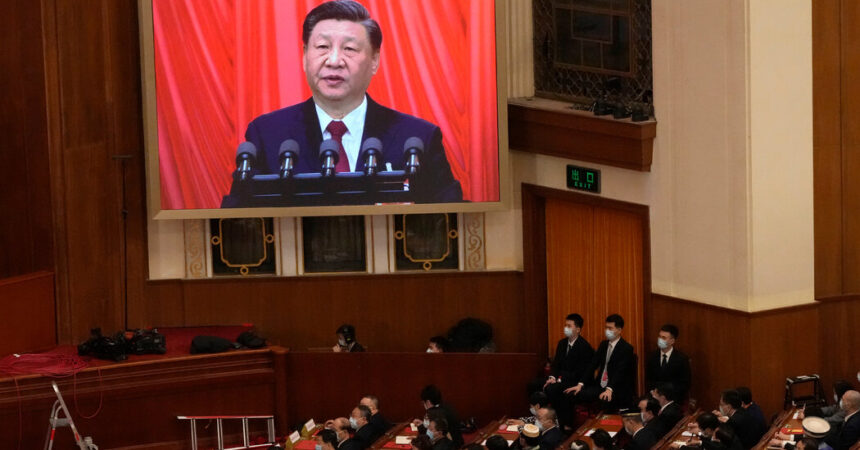

In October, the Communist Social gathering held its once-in-five-years nationwide congress and selected a brand new crew of senior get together officers to work with Xi Jinping, the nation’s high chief. Maneuvering then started to reshuffle the federal government’s senior ranks, which had been anticipated throughout the annual session of the Nationwide Individuals’s Congress in early March, though some modifications of monetary policymakers have been unexpectedly delayed.

China is now able to deal with addressing a variety of financial points, together with worldwide debt, the folks stated. Nevertheless, Beijing nonetheless faces different challenges which will restrict its willingness to cut price, together with a industrial banking system that faces very heavy losses on loans to actual property builders and doesn’t wish to settle for massive losses on loans to growing nations on the similar time.

Chinese language officers provided assist for the debt aid initiatives in broad phrases this week.

Wang Wenbin, a spokesman for the Chinese language Overseas Ministry, stated on Friday that China had put ahead a three-point proposal that included calling for the I.M.F. to extra rapidly share its debt sustainability assessments for nations that want aid, and for collectors to element how they are going to perform the restructurings on “comparable phrases.”

After a gathering in Washington between Yi Gang, China’s central financial institution governor, and Mr. Musokotwane of Zambia, the Chinese language central financial institution launched a quick assertion.

“They exchanged views on problems with widespread concern together with bilateral monetary cooperation,” it stated.

Keith Bradsher contributed reporting from Beijing.