Apple financial savings account

Apple

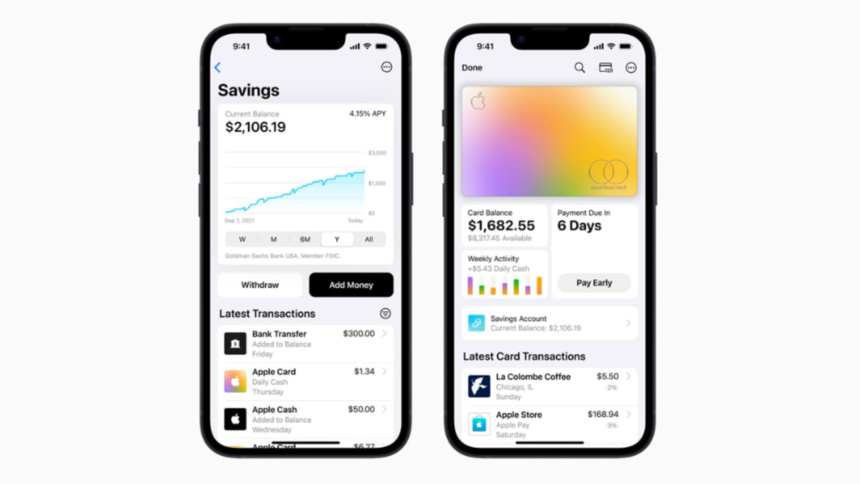

Apple on Monday launched its Apple Card financial savings account with a 4.15% annual share yield. It requires no minimal deposit or stability, Apple stated, and customers can arrange an account from the Pockets app on their iPhones.

The corporate stated in a press launch that every one Day by day Money rewards earned by way of the Apple Card will robotically be deposited to the financial savings account. Day by day Money is the Apple Card reward program that gives as much as 3% again on purchases. Customers can change the place their Day by day Money is deposited at any time, and may add funds from their checking account to construct on their earnings.

Apple is launching the financial savings account by way of Goldman Sachs.

The nationwide common APY on financial savings accounts is simply 0.35%, in line with the Federal Deposit Insurance coverage Company, so Apple’s 4.15% APY is excessive compared. However competing financial savings accounts provided by massive credit score unions, on-line banks and brick-and-mortar banks may supply clients a big APY.

CIT Financial institution provides a financial savings account with a 4.75% APY when clients deposit a minimal stability of $5,000. Marcus by Goldman Sachs has a 3.9% APY with no minimal stability or month-to-month charges. Capital One’s financial savings account has no minimal stability, and customers can earn a 3.5% APY. Vio Financial institution provides a financial savings account with a 4.77% APY with no minimal stability.

Apple Card financial savings customers can handle their accounts by way of a dashboard that can seem within the Pockets app, the place they will monitor their curiosity and their account stability or withdraw funds.