The perfect hope for avoiding a collapse of ailing lender First Republic hinges on how persuasive one group of bankers could be with one other group of bankers.

Advisors to First Republic will try to persuade the massive U.S. banks who’ve already propped it up into doing another favor, CNBC has realized.

The pitch will go one thing like this, in line with bankers with information of the scenario: Buy bonds from First Republic at above-market charges for a complete loss of some billion {dollars} – or face roughly $30 billion in FDIC charges when First Republic fails.

It is the most recent twist in a weekslong saga sparked by the sudden collapse of Silicon Valley Financial institution final month. Days after the federal government seized SVB and Signature, mid-sized banks hit by extreme deposit runs, the nation’s largest banks banded collectively to inject $30 billion in deposits into First Republic. That resolution proved fleeting after the depth of the corporate’s issues grew to become recognized.

If the First Republic advisors handle to persuade massive banks to buy bonds for greater than they’re value — to take the hit of funding losses for the nice of the banking system, in addition to their very own welfare — then they’re assured that different events will step as much as assist the financial institution recapitalize itself.

The advisors have already lined up potential purchasers of latest First Republic inventory in that state of affairs, in line with the sources.

Essential days

These funding bankers are actually in search of to create a way of urgency. CNBC’s David Faber, who first reported on the rescue plan Tuesday, stated that the approaching days are essential for First Republic.

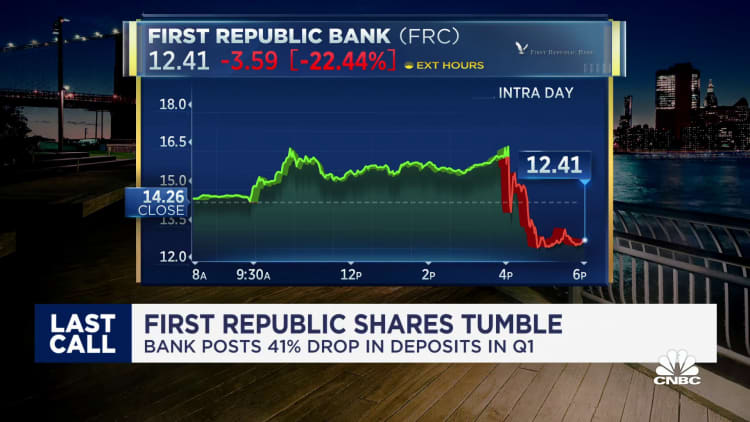

The financial institution’s inventory has been in freefall since disclosing Monday that its deposits fell a staggering 41% just lately, leaving it with $104.5 billion in deposits, together with the infusion from massive banks. Analysts masking the corporate revealed pessimistic reviews after CEO Michael Roffler opted to not take any questions after a short 12-minute convention name.

“Now that the earnings are out, as soon as you’ve got received a window to behave, it is time to do it,” stated one of many bankers, who requested for anonymity to talk candidly. “You by no means know what is going to occur for those who wait, and you do not need to be coping with an emergency scenario.”

To assist a deal occur, advisors might provide warrants or most well-liked inventory in order that banks concerned within the rescue can reap a number of the upside of saving First Republic, the sources stated.

False begins

For years, First Republic was the envy of friends as its deal with wealthy People helped turbocharge progress and allowed it to poach expertise. However that mannequin broke down within the aftermath of the SVB failure as its rich clients rapidly pulled uninsured deposits.

Lazard and JPMorgan Chase had been employed final month to advise First Republic, in line with media reviews.

The important thing benefit of the advisors’ plan, they are saying, is that it permits First Republic to dump some, however not all of its underwater bonds. In a authorities receivership, the entire portfolio should get marked down without delay, leading to what Morgan Stanley analysts estimated to be a $27 billion hit.

One complication, nonetheless, is that the advisors are counting on the U.S. authorities to summon financial institution CEOs collectively to discover attainable options.

There have been false begins already: One top-four U.S. financial institution stated that the federal government advised them to be able to act on the First Republic scenario this previous weekend, however nothing occurred.

Huge financial institution doubts

Whereas the precise contour of any deal is a matter for negotiation and will embody a particular function car or direct purchases, a number of prospects tackle the financial institution’s ailing steadiness sheet.

First Republic loaded up on low-yielding belongings together with Treasuries, municipal bonds and mortgages, making what was primarily a guess that rates of interest would not rise. After they did, the financial institution discovered itself with tens of billions of {dollars} in losses. The financial institution is weighing the sale of $50 billion to $100 billion in debt, Bloomberg reported Tuesday.

By drastically decreasing the dimensions of its steadiness sheet, the financial institution’s capital ratios will all of the sudden be far more healthy, paving the best way for it to lift extra funds and proceed as an impartial firm.

Different attainable, however less-likely strikes embody changing the massive financial institution’s deposits into fairness, and even discovering a purchaser. However a suitor hasn’t emerged up to now month, and is not probably on condition that any purchaser would additionally personal the losses on First Republic’s steadiness sheet.

That has led sources near the massive banks to consider that the most probably state of affairs for First Republic is authorities receivership, which is how SVB and Signature had been resolved.

These near the banks had been hesitant to endorse a plan by which they must acknowledge losses for overpaying for bonds. In addition they expressed mistrust of government-brokered offers after a number of the pacts from the 2008 monetary disaster ended up being costlier than anticipated.

Open vs closed

However the failures of SVB and Signature – the 2 largest because the 2008 monetary disaster – price the FDIC Deposit Insurance coverage Fund many billions of {dollars}, which is paid for by member banks. In addition they benefited the consumers who had been in a position to cherry-pick the perfect belongings whereas the FDIC retains underwater bonds, the First Republic advisors famous.

Advisors referred to the private-market options because the “open financial institution” choice, whereas authorities receivership is the “closed-banked” state of affairs.

However there’s a third chance: the financial institution grinds on as is, slowly shedding but extra worth amid possible quarterly losses, expertise flight and unceasing doubts.

“Time, by the best way, isn’t the financial institution’s pal,” analyst Don Bilson wrote Tuesday. “If something, final evening’s discouraging replace will make it even tougher for First Republic to maintain what it has.”