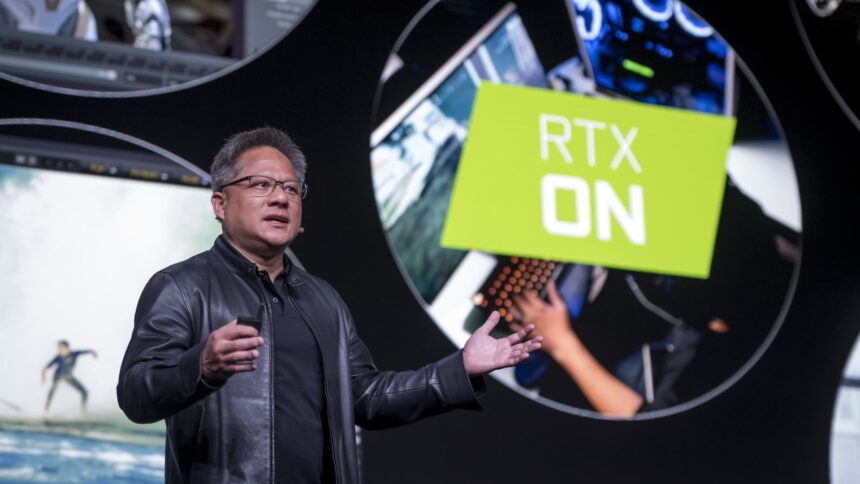

Jensen Huang, president and CEO of Nvidia, speaks in the course of the firm’s occasion on the 2019 Client Electronics Present in Las Vegas on Jan. 6, 2019.

David Paul Morris | Bloomberg | Getty Photographs

Shares of Nvidia are closed up 24% on Thursday on the again of an outsize earnings report that beat consensus estimates, reaching an all-time excessive.

Nvidia’s prior file excessive occurred in November 2021, when share worth closed over $333. Shares opened Thursday at $385 and gave again a few of the in a single day positive factors.

To place its acquire in perspective, Nvidia inventory was up 235% since its two-year low of $112 on Oct. 14, beating out the efficiency of some other S&P 500 firm since then. Meta is the second best-performing inventory with a acquire of 97% throughout the identical time interval.

The chipmaker’s market cap was on monitor to open at $975 billion after a 30% leap in after-hours buying and selling Wednesday. The corporate reported first-quarter adjusted earnings per share of $1.09, versus a Refinitiv consensus estimate of 92 cents. Its first-quarter income of $7.19 billion was considerably above a consensus estimate of $6.52 billion.

Nevertheless it was the chipmaker’s main place as an AI chip provider, coupled with it guiding to $11 billion in gross sales for the present interval, that will have despatched shares hovering even larger.

The share worth rise places Nvidia inside attain of a trillion-dollar valuation, one thing solely a handful of publicly traded firms have ever achieved. Apple was first valued at $1 trillion in 2018 and reached a $3 trillion valuation in 2022. Alphabet, Amazon, Saudi Aramco, Tesla, Meta and Microsoft have all at one level been valued at $1 trillion or extra.

Analysts moved quickly to up worth targets for Nvidia after the corporate reported earnings outcomes. JPMorgan doubled its worth goal from $250 to $500 and reiterated its chubby ranking. “Generative AI and huge language/transformer fashions are driving accelerating demand,” JPMorgan analyst Harlan Sur stated.

“What can we are saying different than simply WOW,” Evercore analyst C.J. Muse wrote in a Wednesday notice. Evercore raised its worth goal from $320 to $500 and reiterated its outperform ranking.

Nvidia’s meteoric rise in valuation is not lifting different chipmakers, nonetheless. The AI chip craze has been pushed by demand for high-powered graphics processing models, or GPUs. The corporate has been a historic outperformer within the high-performance “discrete” GPU market, particularly in contrast with Intel.

Nvidia shares have markedly outperformed each Intel and AMD’s share costs.

However neither Intel, which has reportedly struggled to deal with stock issues and lately executed important value cuts, nor AMD has been in a position to obtain the identical degree of share worth progress as Nvidia. Intel shares have been up almost 10% 12 months so far at market shut Wednesday; AMD shares have been up 67% in that very same time.

Nvidia shares at the moment are up 160.6% year-to-date.

— CNBC’s Michael Bloom, Robert Hum and Kif Leswing contributed to this report.

Correction: This story has been up to date to mirror that Nvidia shares are set to shut at an all-time excessive Thursday. A earlier model misstated the day.