Since launching in 2021, lots of of hundreds of customers have used the TPG App to trace greater than 100 billion factors and miles.

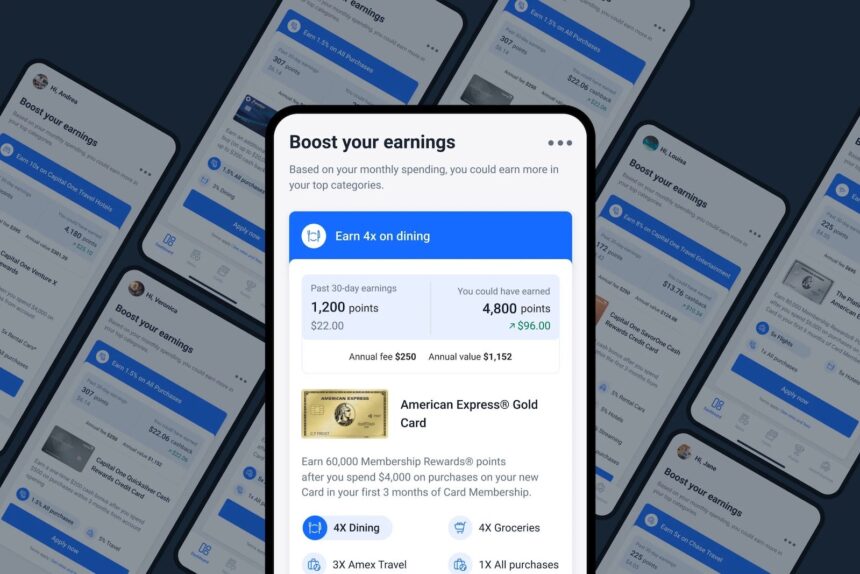

To assist customers maximize their factors potential much more, the TPG App has a brand new characteristic referred to as “Rewards Enhance,” giving customers much more personalised insights into selecting their subsequent bank card.

How the brand new characteristic works

The TPG App already tracks customers’ spending throughout all of their linked playing cards, together with through its “Out Making a Buy” Card Advisor characteristic, which helps customers select essentially the most optimum bank card already of their pockets for a particular buy in actual time.

The app’s newest characteristic, “Rewards Enhance,” analyzes customers’ current spending habits to suggest a bank card primarily based on their highest spending class to maximise earnings. It additionally exhibits customers precisely what number of factors they might have earned the earlier month through the use of these playing cards.

For instance, for example you spent a big sum of money, $1,200, on eating final month through your Capital One Enterprise Rewards Credit score Card.

Rewards Enhance would let you understand that 2 miles per greenback per buy earned from the Enterprise card would equate to 2,400 miles monthly. This card earns customers 2 miles per greenback per buy, a stellar return for flat-rate rewards and definitely higher than incomes no rewards in any respect. Nevertheless, Rewards Enhance would notify you that one other card, such because the American Specific® Gold Card, would have earned you extra because it earns 4 factors per greenback on eating at eating places (together with takeout and supply within the U.S.) along with 4 factors per greenback on as much as $25,000 in purchases at U.S. supermarkets per calendar yr (then 1 level per greenback).

Join our day by day publication

By utilizing an Amex Gold on these eating purchases, you can have earned 4,800 factors, equal to $96 when used as Amex Membership Rewards, per present TPG valuations. If Might was a typical month for eating spending for this individual, then over time, utilizing this card would equate to over $1,150 yearly in factors simply within the restaurant and eating class.

Although you could be deterred by the Amex Gold’s $250 annual price (see charges and costs), Rewards Enhance would inform you that you simply’re nonetheless saving greater than $900 in web factors worth – and that’s earlier than factoring within the aforementioned spending classes, along with 3 factors per greenback on flights booked straight with the airline or by the Amex Journey portal and 1 level per greenback on all different eligible purchases. These incomes charges are on high of the assertion credit score supplied by this card, together with $120 in Uber Money yearly and a $120 annual eating credit score (each divvied up as $10 month-to-month credit).

The true worth of Rewards Enhance

We get it — one of many largest hurdles for getting a brand new bank card is knowing whether or not it should really be worthwhile to you and your private spending habits. Additionally, the excessive annual charges of some playing cards (taking a look at you, The Platinum Card® from American Specific; see charges and costs) could be sufficient to scare off even seasoned bank card veterans.

With Rewards Enhance, you do not have to fret about holding monitor of each credit score, perk or different profit a card presents simply to barely offset an annual price for a card that doesn’t suit your life-style. Rewards Enhance tells you the precise worth you can be saving on a month-to-month and annual foundation simply by switching to utilizing a card to enhance your largest spending class.

Backside line

Not solely does Rewards Enhance present your finest subsequent card, nevertheless it takes all of the guesswork out of whether or not a card will really be a worthwhile addition to your pockets.

Obtain the free TPG App to see how one can increase your rewards as we speak!

Associated studying:

For charges and costs of the Amex Gold Card, click on right here.

For charges and costs of the Amex Platinum Card, click on right here.