By Mr. Maverick

Though some students discover the cyclical principle of social change considerably vapid and outmoded, a extra indifferent look on the present monetary scenario reveals that the U.S. is approaching the top of a long-term debt cycle. The U.S. nationwide debt has exceeded $32 trillion, rising day after day.

The risk has surfaced simply because the world economic system is confronted with an array of threats — from rising inflation and rates of interest to the continued backlash of Russia’s invasion of Ukraine to the tightening grip of authoritarianism. On high of all that, many international locations have grown skeptical of America’s intensive function in international finance. The only indisputable fact that the worldwide superpower has lately been debating over the choice of defaulting on its debt is greater than alarming.

In a nutshell, feeding the anxiousness is the truth that a lot monetary exercise hinges confidence that America will all the time meet its monetary obligations. Its debt, lengthy considered as an ultrasafe asset, is a bedrock of worldwide commerce, constructed on many years of belief in the US. A default might crush the $24 trillion marketplace for Treasury debt, trigger monetary markets to freeze up and ignite a global disaster. “A debt default can be a cataclysmic occasion, with an unpredictable however in all probability dramatic fallout on U.S. and international monetary markets,’’ stated Eswar Prasad, professor of commerce coverage at Cornell College and senior fellow on the Brookings Establishment. However how has the U.S. deteriorated in such a vital monetary situation, threatening the worldwide economic system with a, presumably unprecedented, monetary turmoil ? How have we ended up right here ?

To start with, when confronted with a debt disaster, coverage makers have 4 levers at their disposal to carry debt and debt-service ranges down in relation to the earnings and money movement ranges required to service money owed. They will both succumb to a) austerity, b) default and restructure their debt, c) switch cash and credit score from the haves to the have-nots by e.g. elevating taxes, or, d) print cash and devalue it. In comparison with the others, printing cash is essentially the most handy, least wellunderstood and commonest massive means of restructuring money owed. When one can create cash and credit score and go them out to everybody, it is extremely tough to withstand the temptation to take action.

Extra exactly, when credit score cycles attain their restrict, moderately central banks and central governments will create plenty of debt and print cash which will likely be spent on items, companies and funding property to maintain the economic system transferring. That was adopted in the course of the 2008 debt disaster, when rates of interest might not be lowered as a result of that they had already hit 0 p.c. It additionally occurred a couple of years in the past in response to the plunge triggered by the COVID pandemic. Equally, this financial coverage was adopted in response to the 1929-1932 debt disaster, when rates of interest had additionally been pushed to 0 p.c. In the meanwhile, the creation of debt and cash has been occurring in excessive quantities, surpassing all earlier ranges since World Warfare II.

After many years of actual financial prosperity, the U.S. entered the “bubble prosperity part”, as identified by Ray Dalio. In different phrases, the U.S. has been dealing with a scenario the place there’s a quickly rising debt-financed buy of products, companies, and funding property and the place debt development has been outpacing the capability of the long run money flows to service money owed. This strategy has been adopted for many years. Right this moment, as earlier than, the Federal Reserve continues to print some huge cash and purchase plenty of federal authorities debt, financing the federal government spending that’s a lot greater than the federal authorities’s consumption. This coverage has facilitated the federal authorities and people it’s attempting to assist, although it has on the identical time price those that are holding {dollars} and greenback debt so much in actual buying energy.

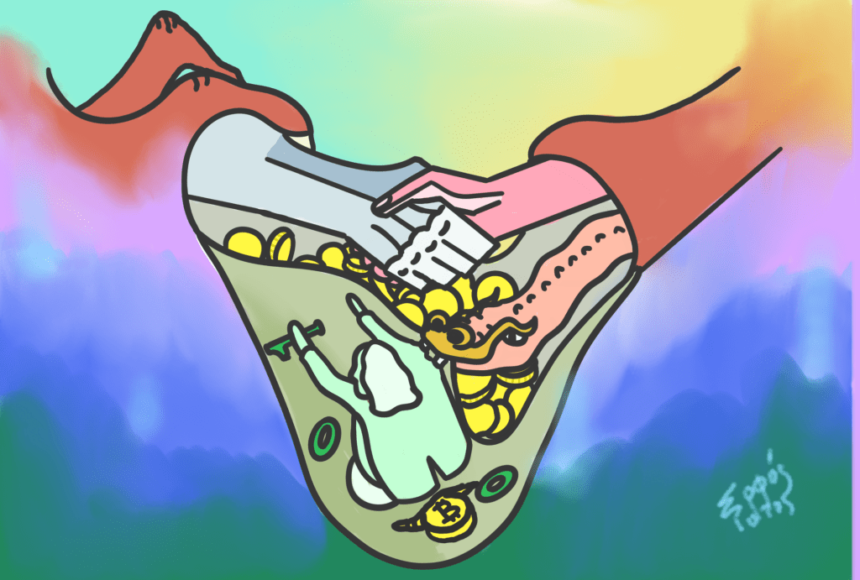

Proper now, the U.S. is able the place debt ranges are extraordinarily excessive, rates of interest can’t be sufficiently lowered, and the creation of cash and credit score has elevated the monetary asset costs greater than it has elevated precise financial exercise. At such occasions, plausibly, those that are holding the debt (e.g. U.S. Treasuries, company bonds, and so on) sometimes wish to alternate the debt they’re holding for different storeholds of wealth (e.g. gold), a bent that creates a “financial institution run” dynamic. Subsequently, as soon as it’s extensively perceived that cash and debt property are not good storeholds of wealth, the long-term debt cycle has reached its finish, and a restructuring of the financial system ensues.

In the meanwhile of writing, holding debt is just like holding a ticking bomb that rewards whereas it retains on ticking and blows you up when it stops. Traditionally, it has been noticed that massive monetary eruptions, specifically massive defaults or massive devaluations, occur each 50 to 75 years. So at which level are we now ?

On Could thirty first, 2023, the debt ceiling invoice handed by the Home of Representatives suspended the federal government’s borrowing restrict till January 2025, guaranteeing that the problem is not going to resurface earlier than the following presidential election. Inside two days, President Joe Biden signed the debt ceiling invoice, averting, or suspending, an economically disastrous default on the federal authorities’s debt. The stakes couldn’t be larger, with the President pulling the nation from the brink of default, which might have despatched shockwaves via the worldwide economic system. However the query is, has the bomb been defused ? It undoubtedly hasn’t. The issue hasn’t been solved, it has simply been swept beneath the carpet.

An indeniable financial precept that hardly anybody acknowledges, is that governments aren’t themselves wealthy entities with stacks of cash mendacity round. They’re their folks collectively, who will finally must pay for the creation and giving out of cash. Briefly, when push involves shove, the U.S. will inevitably have to deal with this pressing challenge, and its repercussions will likely be porfoundly felt internationally.

In a worst case situation scenario, one would possibly moderately ponder over the next questions: does a attainable depreciation of the greenback, the world’s reserve foreign money, sign a wider depreciation of paper cash generally, rendering a restructuring of the present fiat financial system mandatory ? Will folks flee, in the long term, from the depreciating paper cash in the direction of onerous foreign money coinage and different storeholds of wealth, like Bitcoin and cryptocurrencies ? All of it stays to be seen.