At Safaricom’s fifteenth Annual Common Assembly (AGM), shareholders authorized the creation of two new subsidiaries, marking a major milestone in supporting tech entrepreneurs, fostering innovation, and solidifying Safaricom’s position as an important enabler of Kenya’s tech group.

1. Empowering Seed-Stage Begin-ups: Incorporating a Firm Restricted by Assure

Safaricom’s dedication to supporting seed-stage start-ups sees the incorporation of an organization restricted by assure, constructing on the success of the Spark Fund—an funding entity ruled by a Board of Trustees.

This new entity goals to streamline administrative processes, improve governance, and supply additional empowerment and nurturing of seed-stage start-ups throughout Kenya.

2. Accelerating Safaricom’s Mission: The New Non-public Restricted Legal responsibility Firm

Moreover, a brand new personal restricted legal responsibility firm can be established to put money into strategically aligned, mature entities, facilitating Safaricom’s mission of turning into a tech firm by 2025.

This new subsidiary will function the first funding automobile for all strategic investments undertaken by Safaricom PLC.

CEO’s Imaginative and prescient: Empowering the Tech Ecosystem and Unlocking New Alternatives

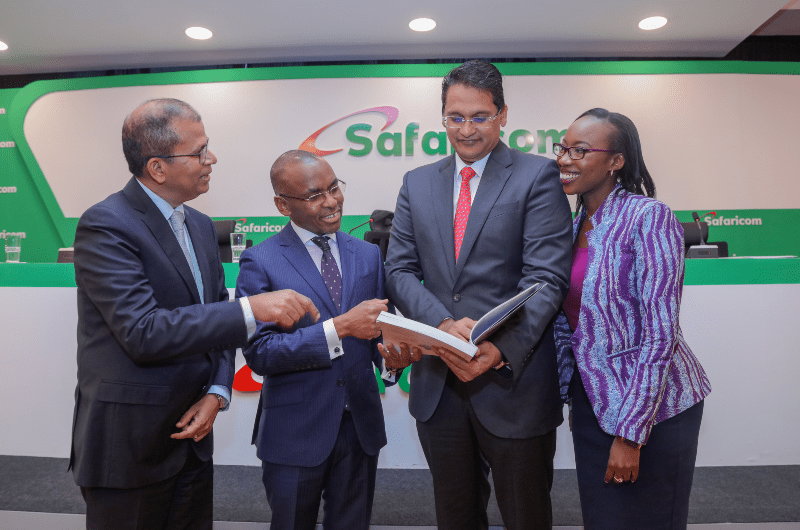

Safaricom CEO, Mr. Peter Ndegwa, emphasised the corporate’s dedication to empowering the tech ecosystem in Kenya and past. He defined that incorporating these subsidiaries is pivotal in attaining Safaricom’s goal of turning into a purpose-led expertise firm.

The brand new firms will play an important position in increasing Safaricom’s attain into numerous buyer segments and unlocking new enterprise fashions and worth chain alternatives.

Investing in Rising Applied sciences and Tech Entrepreneurs

Mr. Ndegwa expressed the corporate’s intent to put money into and assist early-stage firms, particularly these concerned in rising applied sciences akin to analytics, Machine Studying, Synthetic Intelligence, and the Web of Issues.

Safaricom plans to launch a name for purposes within the coming weeks to establish and again promising tech start-ups.

Shareholders’ Help and Dividend Payout

The approval of the brand new subsidiaries obtained unwavering assist from shareholders. Moreover, on the AGM, shareholders authorized a ultimate dividend of KES 0.62 per extraordinary share, amounting to KES 24.84 billion.

That is along with an interim dividend of KES 0.58 per extraordinary share, totaling KES 23.24 billion, authorized by the Board in February 2023. The entire dividend for the 12 months stands at KES 48.08 billion, representing KES 1.20 per share for the 12 months ended 31 March 2023.

The dividend can be payable on or about 31 August 2023 to shareholders on the Register of Members as of 28 July 2023.

Safaricom’s Resilience Amidst Challenges

Regardless of working amidst powerful situations, together with elevated regulatory scrutiny, adjustments in taxation insurance policies, political uncertainty, financial slowdown, and different challenges, Safaricom exhibited resilience and delivered a stable general efficiency throughout the 12 months.

Safaricom’s approval of two new subsidiaries demonstrates its unwavering dedication to driving tech innovation, fostering entrepreneurship, and making a long-lasting impression on society.

By investing in tech entrepreneurs and aligning with their strategic mission, Safaricom continues to attach folks, alternatives, and knowledge whereas driving innovation, creating worth, and delivering superior efficiency for all stakeholders.