A development in a multifamily and single household residential housing advanced is proven within the Rancho Penasquitos neighborhood, in San Diego, California, September 19, 2023.

Mike Blake | Reuters

In concept, getting inflation nearer to the Federal Reserve’s 2% goal would not sound terribly troublesome.

The primary culprits are associated to companies and shelter prices, with lots of the different elements displaying noticeable indicators of easing. So concentrating on simply two areas of the financial system would not look like a gargantuan process in comparison with, say, the summer time of 2022 when principally all the things was going up.

In observe, although, it may very well be more durable than it seems.

Costs in these two pivotal elements have confirmed to be stickier than meals and fuel and even used and new automobiles, all of which are typically cyclical as they rise and fall with the ebbs and flows of the broader financial system.

As an alternative, getting higher management of rents, medical care companies and the like may take … nicely, you may not wish to know.

“You want a recession,” stated Steven Blitz, chief U.S. economist at GlobalData TS Lombard. “You are not going to magically get right down to 2%.”

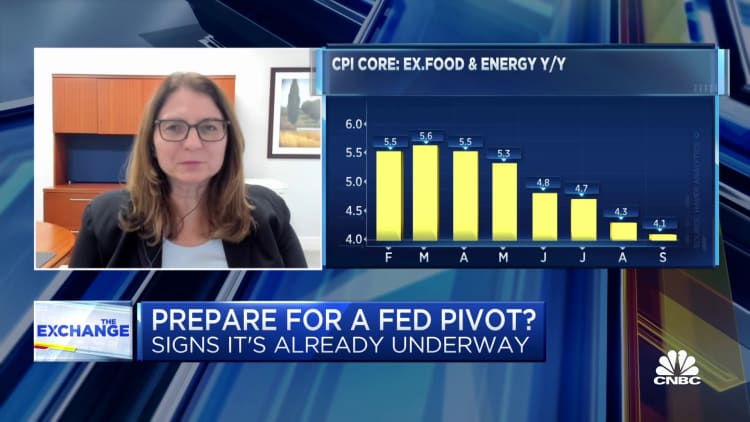

Annual inflation as measured by the buyer worth index fell to three.7% in September, or 4.1% when you kick out unstable meals and vitality prices, the latter of which has been rising steadily of late. Whereas each numbers are nonetheless nicely forward of the Fed’s objective, they characterize progress from the times when headline inflation was operating north of 9%.

The CPI elements, although, advised of uneven progress, helped alongside by an easing in objects comparable to used-vehicle costs and medical care companies however hampered by sharp will increase in shelter (7.2%) and companies (5.7% excluding vitality companies).

Drilling down additional, lease of shelter additionally rose 7.2%, lease of main residence was up 7.4%, and house owners’ equal lease, pivotal figures within the CPI computation that signifies what owners suppose they may get for his or her properties, elevated 7.1%, together with a 0.6% acquire in September.

With out progress on these fronts, there’s little probability of the Fed reaching its objective anytime quickly.

Uncertainty forward

“The forces which might be driving the disinflation among the many numerous bits and micro items of the index ultimately give solution to the broader macro power, which is rising, which is above-trend progress and low unemployment,” Blitz stated. “Finally that can prevail till a recession is available in, and that is it, there’s nothing actually way more to say than that.”

On the brilliant aspect, Blitz is amongst these within the consensus view that see any recession being pretty shallow and brief. And on the even brighter aspect, many Wall Road economists, Goldman Sachs amongst them, are coming round to the view that the much-anticipated recession might not even occur.

Within the interim, although, uncertainty reigns.

“Sticky-price” inflation, a measure of issues comparable to rents, numerous companies and insurance coverage prices, ran at a 5.1% tempo in September, down a full share level from Could, in line with the Cleveland Fed. Versatile CPI, together with meals, vitality, automobile prices and attire, ran at only a 1% fee. Each characterize progress, however nonetheless not a objective achieved.

Markets are puzzling over what the central financial institution’s subsequent step shall be: Do policymakers slap on one other fee hike for good measure earlier than year-end, or do they merely stick with the comparatively new higher-for-longer script as they watch the inflation dynamics unfold?

“Inflation that’s caught at 3.7%, coupled with the sturdy September employment report, may very well be sufficient to immediate the Fed to certainly go for another fee hike this yr,” stated Lisa Sturtevant, chief economist for Vivid MLS, a Maryland-based actual property companies agency. “Housing is the important thing driver of the elevated inflation numbers.”

Larger rates of interest’ greatest affect has been on the housing market when it comes to gross sales and financing prices. But costs are nonetheless elevated, with concern that the excessive charges will deter development of latest residences and preserve provide constrained.

These components “will solely result in increased rental costs and worsening affordability situations in the long term,” wrote Christopher Bruen, senior director of analysis on the Nationwide Multifamily Housing Council. “Rising charges threaten the energy of the broader job market and financial system, which has not but absolutely digested the speed hikes already enacted.”

Longer-run considerations

The notion that fee will increase totaling 5.25 share factors have but to wind their means by means of the financial system is one issue that would preserve the Consumed maintain.

That, nonetheless, goes again to the concept the financial system nonetheless wants to chill earlier than the central financial institution can full the ultimate mile of its race to carry down inflation to the two% goal.

One optimistic within the Fed’s favor is that pandemic-related components largely have washed out of the financial system. However different components linger.

“Pandemic-era results have a pure gravitational pull and we have seen that happen over the course of the yr,” stated Marta Norton, chief funding officer for the Americas at Morningstar Wealth. “Nonetheless, bringing inflation the rest of the gap to the two% goal requires financial cooling, no simple feat, given fiscal easing, the energy of the buyer and the final monetary well being within the company sector.”

Fed officers count on the financial system to gradual this yr, although they’ve backed off an earlier name for a gentle recession.

Policymakers have been banking on the notion that when present rental leases expire, they are going to be renegotiated at decrease costs, bringing down shelter inflation. Nonetheless, the rising shelter and house owners’ equal lease numbers are operating counter to that pondering although so-called asking lease inflation is easing, stated Stephen Juneau, U.S. economist at Financial institution of America.

“Subsequently, we should look forward to extra knowledge to see if that is only a blip or if there’s something extra elementary driving the rise comparable to increased lease will increase in bigger cities offsetting softer will increase in smaller cities,” Juneau stated in a word to shoppers Thursday. He added that the CPI report “is a reminder that we would not have good historic examples to lean on” for long-term patterns in lease inflation.