Japan’s Nikkei 225 has been the highest performer this yr, amongst giant financial system inventory indexes in Asia and plenty of consider that shares within the area have extra room to run in 2024.

Marco Bottigelli | Second | Getty Photos

Asia-Pacific markets rose to new highs in 2023, with Japan’s Nikkei 225 rising because the top-performing fairness index. The area is predicted to proceed its good run into the following yr as nicely.

So, which markets will outperform in 2024?

Based on analysts that spoke to CNBC, Asia-Pacific’s top-performing markets within the first half of 2024 can be India, Japan and Vietnam — this is why.

1. India

India’s inventory market emerged as one of many area’s favourite final yr and buyers are bullish on the nation’s long-term prospects.

The benchmark Nifty 50 index gained 20% in 2023, and hit a string of record-highs.

India’s financial development is predicted to outpace different main Asian economies in 2024, with the Worldwide Financial Fund projecting the nation’s actual GDP to develop by 6.3% this yr, the identical price as is predicted for 2023.

India’s development prospects have been a strong driver for its shares at a time when its neighbor and the area’s greatest financial system, China, was seen struggling to satisfy its goal of 5% GDP development for 2023.

Indian inventory markets have additionally benefitted from robust earnings, imminent rate of interest cuts and better participation from home buyers. All of that are anticipated to hold the Nifty 50’s document rally into the following yr.

The wildcard for 2024 would be the nation’s basic elections. Strategists from J.P. Morgan stated in a observe that they see the Nifty 50 hitting 25,000 subsequent yr, if the ruling nationalist Bharatiya Janata Celebration retains energy.

The goal of 25,000 represents a greater than 15% upside from the index’s final shut of 21,710.

Nonetheless, JPM warned that “if the overall election outcomes are sudden, together with a worldwide recession, geopolitical tensions, larger oil costs, or larger home unemployment,” the Nifty might fall to 16,000.

2. Japan

Japan’s Nikkei 225 was the highest performing inventory index in Asia final yr, and analysts consider the nation’s fairness markets have extra room to run in 2024.

The rally in Japan shares noticed the the blue-chip Nikkei 225 gaining 28% final yr and the broader Topix ending 25% larger.

Japanese shares have been boosted by robust earnings and rising hopes that the Financial institution of Japan could lastly finish its extremely simple financial coverage after a long time of near-zero rates of interest.

Masashi Akutsu, a strategist at BofA World Analysis stated he expects the rally in Japan markets to proceed nicely into 2024, additionally noting an increase in international investments.

Strategists at BofA see the Nikkei 225 touching 37,500 by the top of 2024. The index presently trades at round 33,464.17.

Akutsu stated expertise and banks have been BofA’s prime picks for subsequent yr, because the sectors steadiness out a portfolio with each development and value-focused shares, at a time when markets anticipate the Financial institution of Japan to finish its ultra-loose financial coverage.

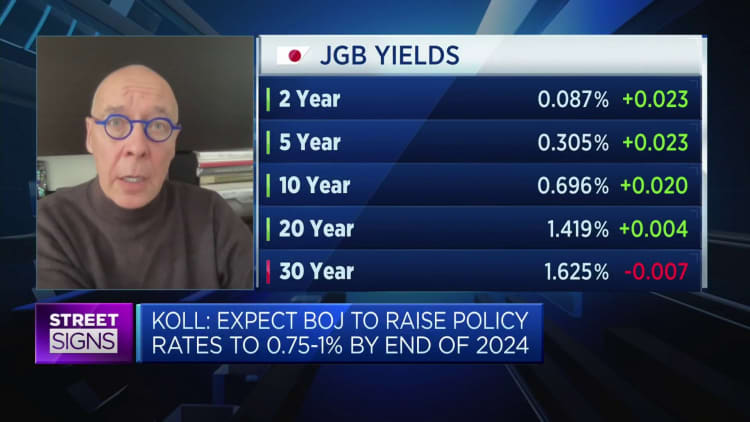

The BOJ’s wrapped up its remaining assembly of 2023 leaving rates of interest inside the destructive territory at -0.1%, whereas sticking to its yield curve management coverage that retains the higher restrict for 10-year Japanese authorities bond yield at 1% as a reference.

A slowing financial system and cooling inflation, nonetheless, might pose as a possible problem for the BOJ on the subject of unwinding its ultra-easy stance. Traders will even keenly await the annual spring wage negotiations subsequent yr to substantiate a pattern of any significant will increase to wages.

3. Vietnam

Similar to India and Japan, Vietnam has benefited from the “China plus one” technique with firms diversifying investments to assist scale back their reliance on China.

The nation expects to see a 6% to six.5% GDP development in 2024 on the again of strong imports and exports, in addition to stronger manufacturing exercise.

The optimism within the Vietnamese market has additionally led to a greater than 14% surge in international direct investments final yr in contrast with 2022.

Based on LSEG information, $29 billion in international direct investments have been pledged to Vietnam from January to November final yr.

China accounts for half of the brand new FDI inflows into Vietnam this yr, reflecting the attractiveness of the Southeast Asian nation as a rising manufacturing hub, Yun Liu, ASEAN economist at HSBC stated.

Now’s the precise time for buyers to enter Vietnam shares, Andy Ho, chief funding officer of VinaCapital Group stated.

“Over the following 6 to 12 months, Vietnam can be a great market as valuations are cheap at about 11 to 12 occasions earnings for 2023. That is a couple of 20% to 25% low cost to the regional common,” Ho instructed CNBC.

“The common each day buying and selling quantity in Vietnam has gone from $500 million a yr in the past to a couple of billion {dollars} each day at present,” he stated, elaborating that funding alternatives might be present in consumption, healthcare and actual property sectors.

“Persons are starting to acknowledge that after they have a whole lot of liquidity, they do not wish to put it within the financial institution as a result of the rates of interest now turning into uninteresting, after which taking a look at different choices to take a position.”

A employee scans and checks an merchandise on the cabinets of a Tiki.vn warehouse in Ho Chi Minh Metropolis, Vietnam, on Might 24, 2021.

Yen Duong | Bloomberg | Getty Photos

Traders also needs to be bullish on Vietnam’s e-commerce sector, Tyler Nguyen, vice-president and head of institutional fairness gross sales at Maybank Securities Vietnam stated.

“We’re seeing 20-30% year-on-year development yearly,” he instructed CNBC, mentioning that e-commerce accounts for less than 2-3% of retail gross sales.

When requested about Vietnam’s potential entry into MSCI’s listing of rising market economies, Nguyen stated the frontier financial system was nonetheless “at a really nascent stage” however “we would see excellent news in 2025.”

Is China nonetheless price a play?

Chinese language shopper confidence has not recovered from the pandemic attributable to excessive youth unemployment, debt dangers, and a deadly property sector, inflicting consumption habits to turn into extra “rational,” Jefferies stated in a observe.

Though pessimism within the Chinese language market is unlikely to dissipate quickly, analysts say there are nonetheless shiny spots.

Jefferies expects gross sales development to normalize subsequent yr and has suggested buyers to have a look at consumption sub-sectors comparable to beer and sportswear. Maybank additionally prefers the patron sector, moreover China’s “new financial system” section.

Jefferies can also be bullish on China’s healthcare sector, recommending buyers to “cherry-pick” shares which are poised to see better-than-expected development and margin enlargement.