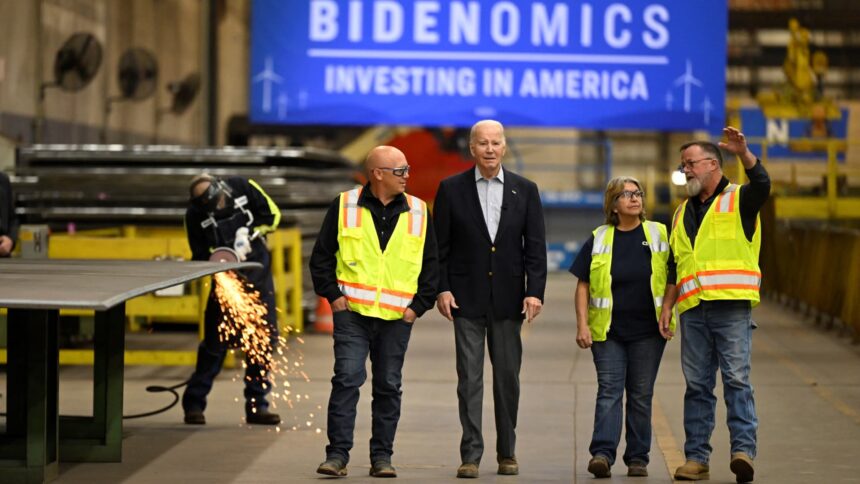

U.S. President Joe Biden speaks with staff whereas visiting CS Wind, the most important wind tower producer on the planet, in Pueblo, Colorado, U.S., November 29, 2023.

Andrew Caballero-Reynolds | AFP | Getty Pictures

This report is from at the moment’s CNBC Every day Open, our worldwide markets e-newsletter. CNBC Every day Open brings traders up to the mark on all the pieces they should know, irrespective of the place they’re. Like what you see? You possibly can subscribe right here.

What you have to know at the moment

Tesla shares plunge 12%

Shares of electrical car maker Tesla plunged 12%, their largest drop in over a yr. The transfer got here a day after the corporate’s earnings missed expectations and it warned of a slowdown in 2024. Tesla’s inventory additionally got here below stress from varied brokers, who lowered their worth targets for the corporate.

Apple opens iPhone retailer in Europe

Apple plans to open up its iPhone App Retailer in Europe to rivals. This transfer opens up cracks within the firm’s well-known “walled backyard,” with which it controls app distribution on its units. This was in response to a brand new European regulation, the Digital Markets Act, which forces huge tech firms to open up their platforms by March of this yr.

Lagarde responds to scathing survey

Christine Lagarde mentioned she was “proud and honored” to guide the European Central Financial institution, after her management was criticized in a union-run survey of workers. Lagarde went on to say that the ECB’s personal surveys prompt individuals have been completely satisfied to work on the central financial institution and had a way of mission.

[PRO] Purchase or keep away from China?

Is it time to get into China markets? Some traders have been cautious since Beijing has been combating a property debt disaster that has triggered monetary dangers throughout the broader economic system. The Professional analysts give their take.

The underside line

What recession?

The U.S. economic system grew at an accelerated tempo within the ultimate three months of 2023, capping the yr on a strong word.

And the recession that so many forecasters had predicted by no means occurred.

The newest GDP knowledge confirmed the economic system grew at a price of three.3% within the fourth quarter, a lot increased than Wall Road’s estimates.

The numbers underlined the U.S. economic system’s outstanding resilience within the face of sustained efforts from the Fed to aggressively hike rates of interest to struggle inflation.

The Biden administration wasted no time in trying to assert credit score. U.S. Treasury Secretary Janet Yellen mentioned authorities insurance policies helped enhance the economic system.

“Although some forecasters thought a recession final yr was inevitable, President Biden and I didn’t,” Yellen mentioned in a speech.” As an alternative of contracting, the economic system has continued to develop, pushed by American staff and President Biden’s financial technique.”

“Put merely, it has been the fairest restoration on report,” Yellen added.

Thursday’s report additionally included excellent news on the inflation entrance. The core private consumption expenditures worth index posted a quarterly acquire of two%, excluding meals and vitality — a key gauge the Fed makes use of when assessing inflation. Headline inflation elevated simply 1.7%.

With all the info pointing in the best path, it seems to be just like the economic system might be inching near the a lot talked about smooth touchdown, if it hasn’t already.

— CNBC’s Jeff Cox contributed to this report.