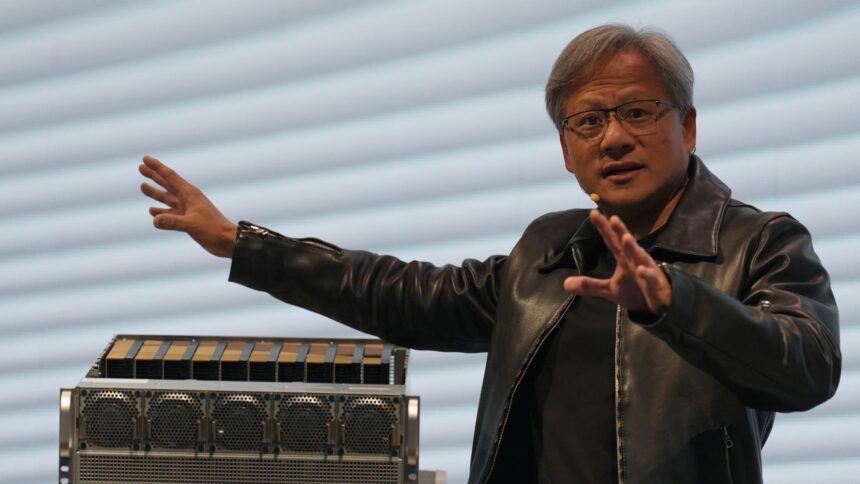

Nvidia CEO Jensen Huang speaks on the Supermicro keynote presentation throughout the Computex convention in Taipei on June 1, 2023.

Walid Berrazeg | Sopa Pictures | Lightrocket | Getty Pictures

Traders have grow to be so enamored with Nvidia’s synthetic intelligence story that they need a chunk of something the chipmaker touches.

On Wednesday, Nvidia disclosed in a regulatory submitting that it has stakes in a handful of public firms: Arm, SoundHound AI, Recursion Prescribed drugs, Nano-X Imaging, and TuSimple.

Aside from Arm, which topped $130 billion in market cap just lately, shares of the Nvidia-backed firms soared Thursday following the 13F submitting, a kind that have to be submitted by institutional funding managers overseeing a minimum of $100 million in property.

However none of those investments could be stunning to anybody who took the time to sift by outdated information stories and filings. The AI mania is firmly in an irrational exuberance section, and buyers are pouncing on something and every little thing within the area.

No inventory is hotter than Nvidia, which handed Amazon in market worth Tuesday after which Alphabet on Wednesday to grow to be the third-most-valuable firm within the U.S., behind solely Apple and Microsoft. Nvidia shares are up greater than 200% over the previous 12 months because of seemingly limitless demand for its AI chips, which underpin highly effective AI fashions from Google, Amazon, OpenAI and others.

SoundHound, which makes use of AI to course of speech and voice recognition, jumped 67% on Thursday, after Nvidia disclosed a stake that amounted to $3.7 million on the time of the submitting. Nvidia invested in SoundHound in 2017 as a part of a $75 million enterprise spherical.

SoundHound went public by a particular function acquisition firm in 2022, and Nvidia was named in its presentation as a strategic investor.

Nano-X makes use of AI in medical imaging. Nvidia’s disclosure of a $380,000 funding within the firm despatched the top off 49% on Thursday. Nvidia’s involvement dates again years to a enterprise funding in Zebra Medical, an Israeli medical imaging startup. Nano-X acquired Zebra in 2021.

TuSimple, an autonomous trucking firm, rocketed 37% on Thursday after the disclosure of Nvidia’s $3 million stake. The share rally comes a month after the corporate introduced plans to delist from the Nasdaq because of a “vital shift in capital markets” since its 2021 IPO. TuSimple debuted at $40 a share and now trades for roughly 50 cents.

“Accordingly, the Particular Committee decided that the advantages of remaining a publicly traded firm not justify the prices,” TuSimple stated in a launch Jan. 17. “The Firm is present process a metamorphosis that the Firm believes it could higher navigate as a personal firm than as a publicly traded one.”

Nvidia invested in TuSimple in 2017, 4 years earlier than the IPO.

Nvidia acquired its stake in biotech firm Recursion extra just lately. Like TuSimple, Recursion went public in 2021, however Nvidia purchased in two years later by what’s referred to as a personal funding in public fairness, or PIPE. Nvidia purchased $50 million value of shares in 2023 and now has an funding value $76 million, in keeping with its submitting.

Recursion shares spiked 14% on Thursday.

Nvidia’s personal financials will probably be on full show subsequent week, when the corporate stories quarterly earnings. Analysts expect year-over-year income progress above 200% to greater than $20 billion.

The corporate’s more moderen investments are prone to be rather more vital than its earlier bets, disclosed late Wednesday, as a result of they’re on the coronary heart of the AI growth. Lately, Nvidia has backed scorching AI startups together with Cohere, Hugging Face, CoreWeave and Perplexity.

“AI is remodeling the best way shoppers entry data,” stated Jonathan Cohen, Nvidia’s vice chairman of utilized analysis, in Perplexity’s announcement of a $73.6 million funding spherical in January. “Perplexity’s world-class crew is constructing a trusted AI-powered search platform that may assist push this transformation ahead.”

WATCH: Perplexity AI goals to rival Google

Do not miss these tales from CNBC PRO: