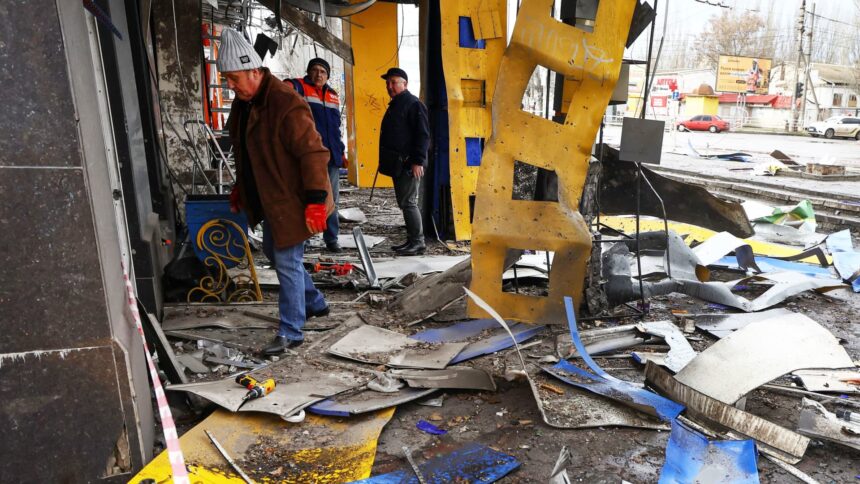

Individuals assist to scrub up particles at a bus station broken after a shelling, amid Russia’s assault on Ukraine, in Kherson, Ukraine February 21, 2023.

Lisi Niesner | Reuters

One 12 months because the begin of Russia’s full-scale invasion, Ukraine’s financial system and infrastructure are in tatters, with the federal government and its allies planning the biggest rebuilding effort since World Battle II.

The World Financial institution estimates that Ukrainian GDP shrank by 35% in 2022, and projected in October that the inhabitants share with earnings beneath the nationwide poverty line would rise to virtually 60% by the tip of final 12 months — up from 18% in 2021.

The World Financial institution has up to now mobilized $13 billion in emergency financing to Ukraine because the battle started, together with grants, ensures and linked parallel financing from the U.S., U.Okay., Europe and Japan.

The Worldwide Financial Fund estimates that the Ukrainian financial system contracted by 30%, a much less extreme decline than beforehand projected. Inflation has additionally begun to decelerate, however ended 2022 at 26.6% year-on-year, in response to the Nationwide Financial institution of Ukraine.

IMF Managing Director Kristalina Georgieva visited Ukraine this week, assembly with President Volodymyr Zelenskyy and NBU Governor Andriy Pyshnyy, amongst others.

In a press release Tuesday, Georgieva stated she noticed “an financial system that’s functioning, regardless of the great challenges,” commending the federal government’s imaginative and prescient to maneuver from restoration to a “transformational interval of reconstruction and EU accession.”

“Retailers are open, companies are being delivered and persons are going to work. That is outstanding testomony to the spirit of the Ukrainian individuals,” Georgieva stated, additionally noting that authorities businesses, financial establishments and the banking system are absolutely operational.

“However the assaults on crucial infrastructure, the financial system is adjusting, and a gradual financial restoration is predicted over the course of this 12 months,” she added.

This handout image taken and launched by the Ukrainian President press-service in Kyiv on Might 16, 2022 reveals Ukrainian President Volodymyr Zelensky (R) and Managing Director of the Worldwide Financial Fund (IMF) Kristalina Georgieva (on the display) holding a video convention.

STR | AFP | Getty Photographs

Georgieva reiterated the IMF’s dedication to supporting Ukraine, and the Washington-based establishment has offered $2.7 billion in emergency loans over the previous 12 months. Nonetheless, additionally it is working with Ukraine beneath an financial coverage monitoring program, a precursor to establishing a fully-fledged IMF lending program, as Kyiv seeks a $15 billion multi-year help bundle.

“The worldwide neighborhood will proceed to have an important function in supporting Ukraine, together with to assist deal with the big financing wants in 2023 and past,” Georgieva concluded.

“The battle in Ukraine has had far-reaching penalties for the native, regional, and world financial system. Provided that we work collectively as a world neighborhood will we have the ability to construct a greater future.”

Huge infrastructure rebuild

At a G-20 assembly on Thursday, U.S. Treasury Secretary Janet Yellen referred to as on the IMF to “transfer swiftly” towards the absolutely financed mortgage program, with Washington readying financial help to the tune of $10 billion within the coming weeks.

The U.S. has offered a cumulative $76.8 billion in bilateral navy, financial and humanitarian support to Ukraine between Jan. 24, 2022, and Jan. 15, 2023, in response to Germany’s Kiel Institute for the World Financial system.

This contains $46.6 billion in navy grants and loans, weapons and safety help, by far outstripping the remainder of the world. The U.Okay. has been the second-largest navy contributor at $5.1 billion, adopted by the European Union at $3.3 billion.

Because the battle enters its second 12 months and reveals no signal of abating, with Russia more and more attacking crucial infrastructure and energy shortages persisting, the Ukrainian financial system is predicted to contract once more this 12 months, albeit at a low single-digit fee.

A current estimate from the Kyiv College of Economics put the entire injury to Ukrainian infrastructure at $138 billion, whereas Zelenskyy has estimated that rebuilding the nation may find yourself costing greater than $1 trillion.

Destruction seen by way of a damaged automotive window in Lyman, Ukraine, on Feb. 20, 2023.

Anadolu Company | Anadolu Company | Getty Photographs

“For the reason that starting of Russia’s battle in opposition to Ukraine, a minimum of 64 massive and medium-sized enterprises, 84.3 thousand models of agricultural equipment, 44 social facilities, virtually 3 thousand retailers, 593 pharmacies, virtually 195 thousand personal automobiles, 14.4 thousand public transport, 330 hospitals, 595 administrative buildings of state and native administration have been broken, destroyed or seized,” the KSE report highlighted.

In the meantime, Ukraine’s finances deficit has risen to a document $38 billion and is predicted to stay elevated, although sturdy exterior help from Western governments and the IMF is probably going, in response to Razan Nasser, rising market sovereign analyst at T. Rowe Value.

“This could assist to plug the financing hole, which in flip ought to assist to scale back reliance on financial financing this 12 months,” Nasser stated.

In its January coverage assembly, NBU officers mentioned a variety of measures geared toward avoiding a return to financial financing of the finances deficit.

Exterior collectors in August agreed to a two-year standstill on sovereign debt, acknowledging the immense strain being exerted by the battle on the nation’s public funds.

“This can doubtless be step one of the restructuring, with a deep haircut on the debt doubtless. It’s troublesome to foretell the dimensions of this debt discount because it is determined by the state of the Ukrainian financial system on the time the restructuring is agreed,” Nasser stated.

He added {that a} “political resolution” will likely be wanted on how a lot personal collectors ought to contribute to the reconstruction prices in gentle of the colossal injury inflicted on infrastructure up to now.

A employee inspects the injury close to a railway yard of the freight railway station in Kharkiv, which was partially destroyed by a missile strike, amid the Russian invasion of Ukraine on September 28, 2022.

Yasuyoshi Chiba | AFP | Getty Photographs

“When this battle does ultimately finish, the size of the reconstruction and restoration effort is prone to eclipse something Europe has seen since World Battle II,” he stated.

This sentiment was echoed on Wednesday by Deputy Prime Minister Yulia Svyrydenko, who instructed Politico throughout an interview in Brussels that the reconstruction ought to begin this 12 months, regardless of there being no speedy finish to the battle in sight.

“It may be the largest reconstruction [since] World Battle II,” she stated. “We have to begin now.”

Though starting the rebuild whereas the battle continues to be ongoing and Russia continues to focus on civilian infrastructure may appear counterintuitive, Daniela Schwarzer, govt director of Open Society, instructed CNBC on Thursday that it was important.

“Ukrainians very clearly make the case that really, reconstruction has to start in some components of the nation whereas the battle continues to be ongoing as a result of for the nation, the destruction of infrastructure — which actually occurs day by day — must be dealt with in any other case individuals cannot dwell, the financial system cannot choose up, and so there’s an enormous activity,” she stated.

“We are going to see over the subsequent few months how worldwide monetary establishments, together with the European ones such because the Worldwide Financial institution of Reconstruction and the European Funding Financial institution together with governments and the EU, plus the USA, however the subsequent necessary query is how can personal investments ultimately be introduced again to Ukraine as a result of governments alone cannot rebuild the nation.”