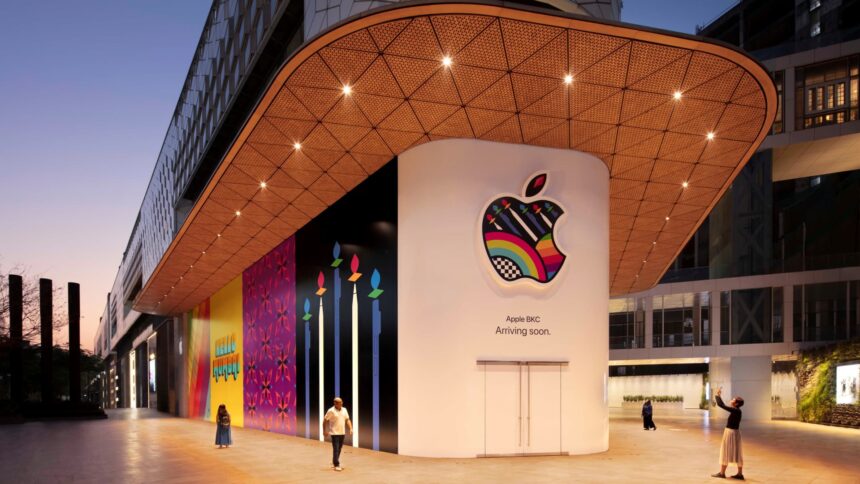

An illustration of the brand new Apple retailer in Mumbai, India

Supply: Apple

India imposed restrictions on the imports of non-public computer systems and tablets, citing safety causes and the necessity to enhance home manufacturing — in a transfer that would impression Samsung and Apple {hardware} gross sales in one of many world’s largest markets for shopper electronics.

Laptops and tablets are amongst a handful of electronics that may require a license to be imported into India, in response to a authorities discover revealed Thursday.

Rajeev Chandrasekhar, India’s data expertise minister, on Friday laid out a cause for the event, citing his nation as one of many world’s fastest-growing markets for digital merchandise.

In a put up on social media platform X, previously often called Twitter, Chandrasekhar stated that the federal government goals to make sure “trusted” {hardware} and programs, to scale back dependence on imports and to extend the home manufacturing of those merchandise.

In principle, corporations from Apple and Samsung to HP will want licenses to import merchandise like laptops and tablets into India.

Apple and Samsung didn’t reply to a CNBC request for remark. On Thursday, Bloomberg had reported that Apple, Samsung and HP had been among the many corporations freezing imports of restricted merchandise to India, citing individuals accustomed to the matter.

The transfer comes as New Delhi seems to place itself as a high-tech manufacturing hub for every thing from shopper electronics to semiconductors. The federal government has sought to lure on this planet’s greatest expertise companies with incentives.

Already, Apple has shifted some manufacturing to India for its newest iPhones. Foxconn, the primary assembler of Apple’s iPhones, introduced a $600 million funding in India this week as a part of a cellphone manufacturing mission and separate semiconductor tools facility.

Tarun Pathak, an analyst at Counterpoint Analysis, stated that the licensing growth may result in value will increase for sure merchandise forward of the Diwali festive season in India in early November.

Pathak stated that the Diwali month festive season accounts for one-fifth of the annual gross sales of those merchandise which have come underneath the most recent restrictions.

“The current restrictions on imports could result in short-term value will increase and a provide crunch for some key manufacturers relying totally on imports. Assembling domestically and even acquiring licenses for such manufacturers will take time,” Pathak advised CNBC.

“With the festive season approaching, there is likely to be some disruptions in provides and reductions as properly and people could not be as aggressive as final 12 months resulting from doable demand and provide mismatches.”