As buyers head to the Berkshire Hathaway annual shareholders assembly this weekend, they’ll relaxation straightforward in a inventory that is not solely buying and selling close to all-time highs, however can also be a protected haven throughout turbulent instances.

Berkshire has a historical past of outperforming the S&P 500 throughout recessions, and performing particularly properly throughout bear markets, based on information from Bespoke Funding Group. Since 1980, Berkshire shares have beat the broader market over the course of six recessions by a median of 4.41 share factors.

Much more spectacular is the inventory’s efficiency throughout bear markets. Throughout the identical time interval, the conglomerate outpaced the S&P 500 every time it dropped 20%, beating the broader index by a median of 14.89 share factors.

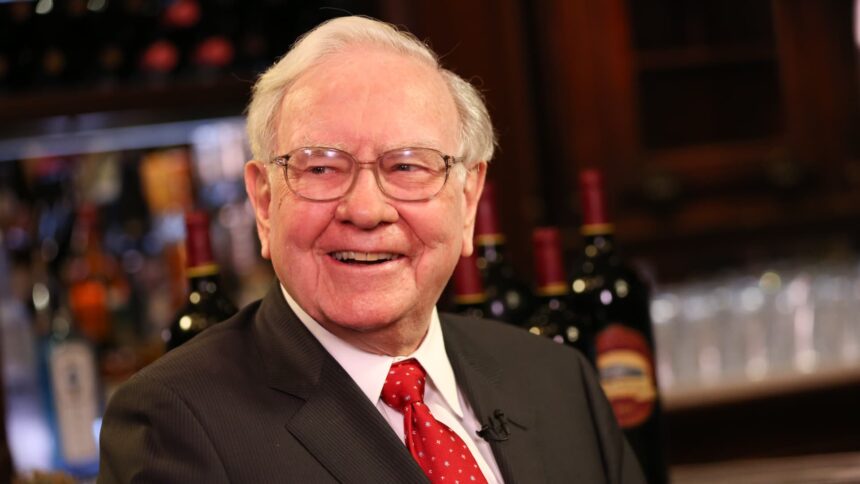

For Warren Buffett, that repute is not any accident, however one which has been constructed over many many years by sustaining a long-term focus to steer buyers via powerful waters, and maintaining conservative investments.

“[One] inventory that has gained a repute for security is Berkshire Hathaway (BRK/A), and primarily based on the final a number of many years, the excellence has been earned,” learn a Bespoke notice from earlier this week.

Lengthy-term focus

Recognized for his value-based investing type, the Oracle of Omaha makes long-term bets on firms that boast robust fundamentals and are more likely to see future progress.

Amongst his notable winners over time is Apple, which he began shopping for in 2016 and which has been in contrast along with his legendary funding in Coca-Cola. The iPhone maker has outperformed all through the bear market, equally driving outperformance for Berkshire as Apple accounts for roughly 45% of the agency’s portfolio, based on CNBC’s Berkshire Hathaway portfolio tracker. It is also about one-quarter of Berkshire’s market cap. Apple shares are up 27% this yr.

“As goes Apple, so goes a great deal of Berkshire,” Bespoke’s Paul Hickey mentioned.

That has helped Berkshire Hathaway Class A shares climb greater than 4% this yr. That is barely under the S&P 500, however the inventory continues to be buying and selling close to 52-week highs it reached simply this week. On Monday, it reached $506,000 per share. It first crossed the half-million-dollar threshold final yr.

For Berkshire shareholders attending this yr’s convention, the inventory worth efficiency proves the worth of holding shares over a protracted time frame.

“The overwhelming majority of the those that present up listed here are over the age of 60. That is who’s gotten wealthy from proudly owning Berkshire Hathaway,” mentioned Invoice Smead, founder and chairman of Smead Capital Administration and a Berkshire shareholder. “Folks held Berkshire Hathaway to a fault and so they received that profit.”

To make sure, his wagers have not at all times paid off. The billionaire investor notoriously offered all his airline shares on the onset of the Covid-19 pandemic, which meant a loss to his funding.

A conservative stance

Buffett has additionally maintained a conservative stance. Whereas that has meant he is generally underperformed throughout bull runs, it is what’s helped the investor beat the market in periods of volatility.

A part of that has to do along with his huge money hoard. Whereas Buffett’s working earnings fell through the fourth quarter in 2022, his money allocation grew to $128.651 billion, up from roughly $109 billion within the third quarter. In actual fact, Buffett mentioned Berkshire will proceed to carry a “boatload” of money and U.S. Treasury payments.

“We can even keep away from conduct that would end in any uncomfortable money wants at inconvenient instances, together with monetary panics and unprecedented insurance coverage losses,” Buffett wrote in his annual shareholder letter. “And sure, our shareholders will proceed to save lots of and prosper by retaining earnings. At Berkshire, there will probably be no end line.”

It additionally has to do along with his long-held affection for insurance coverage firms. The companies which are well-run continually evaluation their dangers to stay worthwhile and are big money mills.

He first purchased property and casualty insurer Nationwide Indemnity greater than a half century in the past, which helped produce money for Berkshire’s future ventures. Final yr, he purchased insurance coverage agency Alleghany in an $11.6 billion transaction, a deal that was Buffett’s largest since 2016.

Up to now, Buffett has referred to as investing a “easy recreation,” and that has proved out over his profession. Berkshire has had a compounded annual acquire of 19.8% from 1965 to 2022, in contrast with 9.9% for the S&P 500 throughout the identical time.

“Buffett, all through his profession, has made a behavior of going towards the gang, and that has served him properly,” Bespoke’s Hickey mentioned. “That is one thing that the majority buyers, whereas they are saying they like to do this, they’ve a a lot tougher time doing in apply.”

— CNBC’s Yun Li contributed to this report