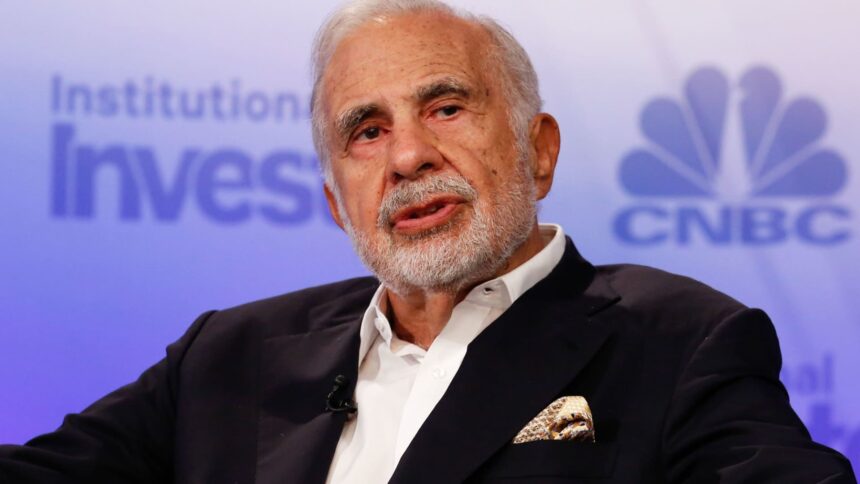

Carl Icahn talking at Delivering Alpha in New York on Sept. 13, 2016.

David A. Grogan | CNBC

Icahn Enterprises, Carl Icahn’s conglomerate, noticed its inventory drop once more Wednesday after a disclosure confirmed regulators are looking for data relating to its company governance.

The shares fell as a lot as 20% in morning buying and selling, following a close to 25% loss final week. A regulatory submitting revealed the U.S. lawyer’s workplace for the Southern District of New York contacted Icahn Enterprises final Wednesday looking for details about company governance, capitalization, securities choices, dividends, valuation, advertising supplies, due diligence and different supplies.

Regulators sought data a day after notable brief vendor Hindenburg Analysis took a brief place towards Icahn’s firm. Hindenburg alleged “inflated” asset valuations final Tuesday, amongst different causes, for what it says is an unusually excessive web asset worth premium in shares of the publicly traded holding firm.

Icahn Enterprises

“The U.S. Lawyer’s workplace has not made any claims or allegations towards us or Mr. Icahn with respect to the foregoing inquiry,” Icahn Enterprises mentioned within the 10-Q submitting.

In a separate assertion, the corporate referred to as Hindenburg’s report “deceptive and self-serving,” saying the Nathan Anderson-led agency used techniques of “wantonly destroying property and harming harmless civilians.”

“Mr. Anderson’s modus operandi is to launch disinformation campaigns to distort firms’ photos, injury their reputations and bleed the hard-earned financial savings of particular person traders,” Icahn Enterprises mentioned. “However, in contrast to a lot of its victims, we is not going to stand by idly. We intend to take all applicable steps to guard our unitholders and struggle again.”

Icahn, probably the most well-known company raider in historical past, made his title after pulling off a hostile takeover of Trans World Airways within the Eighties, stripping the corporate of its property. Most lately, the billionaire investor has engaged in activist investing in McDonald’s and biotech agency Illumina.

Headquartered in Sunny Isles Seashore, Florida, Icahn Enterprises is a holding firm that invests in myriad companies together with power, automotive, meals packaging, metals and actual property.

Icahn mentioned that his agency’s efficiency has been decrease than its historic averages and that is primarily due to its bearish view available on the market.

“We lately have taken steps to cut back the brief positions in our hedge guide and focus for probably the most half on activism, which has served us so nicely up to now,” Icahn mentioned. “We consider our present portfolio has appreciable upside potential over the approaching years.”

Shares of Icahn Enterprises are actually down greater than 35% yr to this point.