Christine Lagarde, president of the European Central Financial institution (ECB), at a charges determination information convention in Frankfurt, Germany, on Thursday, Sept. 14, 2023. The ECB raised rates of interest once more, appearing for the tenth consecutive time to choke inflation out of the euro zone’s more and more feeble financial system.

Bloomberg | Bloomberg | Getty Pictures

The central banks of a number of the world’s greatest economies are actually broadly thought of to have reached, or be on the brink of reaching, the very best degree they are going to take rates of interest.

The European Central Financial institution final week signaled that its Governing Council feels charges could have gotten there.

Following a protracted deliberation over its up to date forecasts for inflation and financial progress and what they need to imply for financial coverage, the ECB hiked its key charge to a document excessive of 4%. Whereas its accompanying assertion under no circumstances dominated out additional hikes fully, it stated charges had been at ranges that if “maintained for a sufficiently lengthy length, will make a considerable contribution to the well timed return of inflation to the goal.”

The short-term inflation outlook stays grim, and set to hit households arduous. ECB employees macroeconomic projections for the euro space now see inflation averaging 5.6% this 12 months, from a previous forecast of 5.4%, and three.2% subsequent 12 months, from a earlier forecast of three%.

However the forecast for 2025, considered one of its most carefully watched metrics measuring the medium-term outlook, was nudged down from 2.2% to 2.1%.

Dialogue will now shift to how lengthy charges will plateau on the present degree, economists together with Berenberg’s Holger Schmieding, stated following the anouncement.

Analysts at Deutsche Financial institution stated they noticed no cuts earlier than September 2024, implying a 12-month pause at 4%.

Challenges to this stay, nonetheless, with one being the prospect of considerably increased oil costs. Crude futures just lately climbed to a 10-month excessive, which might affect items prices and inflation expectations in Europe in addition to the U.S.

Raphael Thuin, head of capital markets methods at Tikehau Capital, stated that regardless of consensus across the finish of the ECB mountaineering cycle, “another and fewer optimistic situation stays attainable: inflation is surprisingly sturdy and resilient, and seems to be structural.”

“Latest disinflationary components (items and commodity costs) appear to be operating out of steam … There’s a threat that, within the absence of a extra convincing downward development in costs, the ECB will think about its battle towards inflation unfinished, with the chance of additional charge hikes on the horizon,” Thuin stated in a be aware.

“On this respect, macroeconomic information developments over the approaching weeks can be decisive.”

Federal Reserve

Fed Chair Jerome Powell made clear final month that additional hikes had been on the desk, and the central financial institution is deeply involved about inflation experiencing a contemporary acceleration if monetary circumstances ease.

In its June forecast, which is more likely to be revised in an up to date projection this week, it didn’t see inflation reaching 2.1% till 2025.

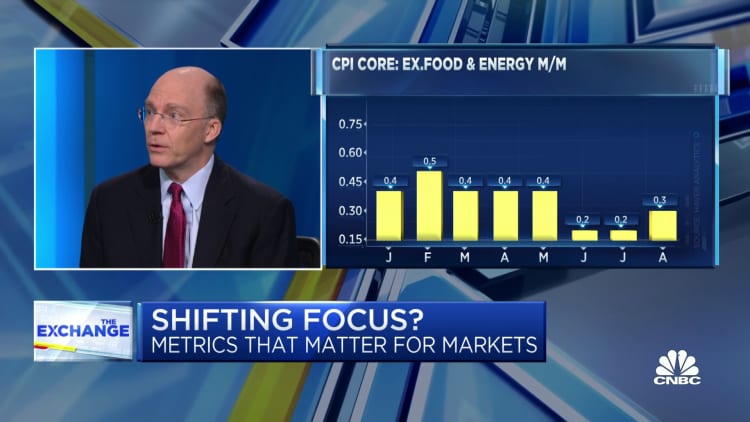

Month-to-month information exhibits persevering with value pressures. The patron value index rose at its quickest month-to-month charge this 12 months in August, primarily pushed by vitality costs, and was 3.7% year-on-year. Core inflation got here in at 0.3% on a month-to-month foundation and 4.3% on an annual foundation, whereas producer value inflation confirmed the largest month-to-month achieve since June 2022.

However markets are all-but sure the U.S. Federal Reserve will maintain charges regular in September, and are break up on whether or not one other hike can be delivered this 12 months. In a Reuters ballot of economists, 20% anticipated no less than one.

“Given the comparatively sturdy financial information and sticky inflation, [the Fed] will preserve a hawkish bias,” economists at J. Safra Sarasin stated in a be aware.

The Federal Open Market Committee “will most likely go away a remaining hike by 12 months finish in its up to date dot plot, regardless that we do not suppose they are going to observe in the end by means of with it.” The dot plot refers back to the rate of interest projections launched quarterly by Fed policymakers.

Markets proceed to anticipate Fed charge cuts subsequent 12 months, although some argue this can be untimely. In the identical Reuters ballot, 28 economists anticipated a primary lower within the first quarter, whereas 33 put it within the second.

Financial institution of England

Expectations for the Financial institution of England are for one remaining hike in September, because it weighs up inflation of 6.8%, with indicators of stresses on the financial system and renewed speak of a “gentle recession.”

In its August report, the Financial Coverage Committee stated it anticipated inflation to hit 5% by the top of the 12 months, to halve by the top of subsequent 12 months, and attain its 2% goal in early 2025.

“The Financial institution is not in a transparent house the place rate of interest hikes are unequivocally mandatory,” stated Marcus Brookes, chief funding officer at Quilter Traders, pointing to weak gross home product information for July.

Analysts at BNP Paribas stated they anticipated a remaining “dovish hike” in September, as wage progress and inflation pressures mix with softening exercise indicators.

Wage progress figures for Might to July held regular at 7.8%, sustaining their document excessive degree, however there have additionally been indicators of a cooling jobs market, with unemployment rising 0.5 proportion factors in the identical interval.

The mortgage market is one other space of weak spot, with funds in arrears spiking to a seven-year excessive within the three months to June.

James Smith, developed markets economist at ING, famous anticipated value progress and anticipated wage progress had each fallen, whereas fewer corporations reported struggling to search out employees.

“A November hike is feasible, however assuming we’re proper in regards to the route of the dataflow and on the idea of latest BoE feedback, we predict a pause remains to be extra doubtless at that assembly,” Smith stated.