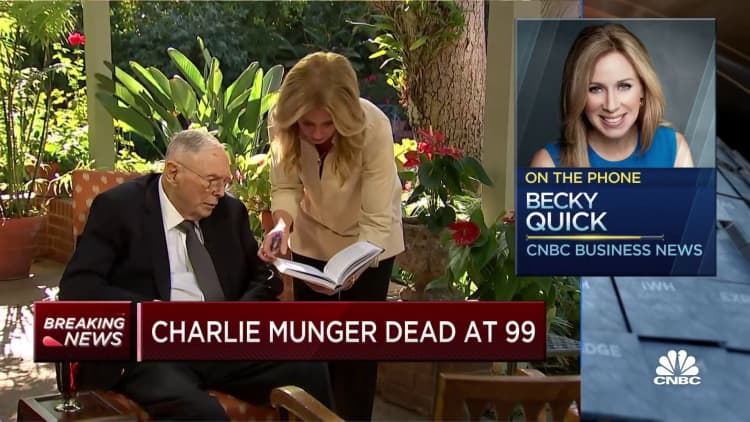

Billionaire Charlie Munger, the investing sage who made a fortune even earlier than he turned Warren Buffett’s right-hand man at Berkshire Hathaway, has died at age 99.

Munger died Tuesday, in accordance with a press launch from Berkshire Hathaway. The conglomerate stated it was suggested by members of Munger’s household that he peacefully died this morning at a California hospital. He would have turned 100 on New 12 months’s Day.

“Berkshire Hathaway couldn’t have been constructed to its current standing with out Charlie’s inspiration, knowledge and participation,” Buffett stated in a press release.

Along with being Berkshire vice chairman, Munger was an actual property lawyer, chairman and writer of the Each day Journal Corp., a member of the Costco board, a philanthropist and an architect.

In early 2023, his fortune was estimated at $2.3 billion — a jaw-dropping quantity for many individuals however vastly smaller than Buffett’s unfathomable fortune, which is estimated at greater than $100 billion.

Throughout Berkshire’s 2021 annual shareholder assembly, the then-97-year-old Munger apparently inadvertently revealed a well-guarded secret: that Vice Chairman Greg Abel “will hold the tradition” after the Buffett period.

Munger, who wore thick glasses, had misplaced his left eye after issues from cataract surgical procedure in 1980.

Munger was chairman and CEO of Wesco Monetary from 1984 to 2011, when Buffett’s Berkshire bought the remaining shares of the Pasadena, California-based insurance coverage and funding firm it didn’t personal.

Buffett credited Munger with broadening his funding technique from favoring troubled corporations at low costs in hopes of getting a revenue to specializing in higher-quality however underpriced corporations.

An early instance of the shift was illustrated in 1972 by Munger’s potential to influence Buffett to log off on Berkshire’s buy of See’s Candies for $25 million regardless that the California sweet maker had annual pretax earnings of solely about $4 million. It has since produced greater than $2 billion in gross sales for Berkshire.

“He weaned me away from the thought of shopping for very so-so corporations at very low-cost costs, figuring out that there was some small revenue in it, and on the lookout for some actually great companies that we might purchase in truthful costs,” Buffett advised CNBC in Might 2016.

Or as Munger put it on the 1998 Berkshire shareholder assembly: “It isn’t that a lot enjoyable to purchase a enterprise the place you actually hope this sucker liquidates earlier than it goes broke.”

Munger was typically the straight man to Buffett’s jovial commentaries. “I’ve nothing so as to add,” he would say after one in every of Buffett’s loquacious responses to questions at Berkshire annual conferences in Omaha, Nebraska. However like his good friend and colleague, Munger was a font of knowledge in investing, and in life. And like one in every of his heroes, Benjamin Franklin, Munger’s perception did not lack humor.

“I’ve a good friend who says the primary rule of fishing is to fish the place the fish are. The second rule of fishing is to always remember the primary rule. We have gotten good at fishing the place the fish are,” the then-93-year-old Munger advised the hundreds of individuals at Berkshire’s 2017 assembly.

He believed in what he known as the “lollapalooza impact,” through which a confluence of things merged to drive funding psychology.

A son of the heartland

Charles Thomas Munger was born in Omaha on Jan. 1, 1924. His father, Alfred, was a lawyer, and his mom, Florence “Toody,” was from an prosperous household. Like Warren, Munger labored at Buffett’s grandfather’s grocery retailer as a youth, however the two future joined-at-the-hip companions did not meet till years later.

At 17, Munger left Omaha for the College of Michigan. Two years later, in 1943, he enlisted within the Military Air Corps, in accordance with Janet Lowe’s 2003 biography “Rattling Proper!”

The army despatched him to the California Institute of Know-how in Pasadena to review meteorology. In California, he fell in love together with his sister’s roommate at Scripps Faculty, Nancy Huggins, and married her in 1945. Though he by no means accomplished his undergraduate diploma, Munger graduated magna cum laude from Harvard Regulation College in 1948, and the couple moved again to California, the place he practiced actual property regulation. He based the regulation agency Munger, Tolles & Olson in 1962 and targeted on managing investments on the hedge fund Wheeler, Munger & Co., which he additionally based that 12 months.

“I am pleased with being an Omaha boy,” Munger stated in a 2017 interview with Dean Scott Derue of the Michigan Ross Enterprise College. “I typically use the previous saying, ‘They obtained the boy out of Omaha however they by no means obtained Omaha out of the boy.’ All these old school values — household comes first; be able so as to assist others when troubles come; prudent, smart; ethical responsibility to be cheap [is] extra essential than anything — extra essential than being wealthy, extra essential than being essential — an absolute ethical responsibility.”

In California, he partnered with Franklin Otis Sales space, a member of the founding household of the Los Angeles Occasions, in actual property. One in all their early developments turned out to be a profitable rental challenge on Sales space’s grandfather’s property in Pasadena. (Sales space, who died in 2008, had been launched to Buffett by Munger in 1963 and have become one in every of Berkshire’s largest traders.)

“I had 5 actual property initiatives,” Munger advised Derue. “I did each aspect by aspect for just a few years, and in a only a few years, I had $3 million — $4 million.”

Munger closed the hedge fund in 1975. Three years later, he turned vice chairman of Berkshire Hathaway.

‘We predict a lot alike that it is spooky’

In 1959, at age 35, Munger returned to Omaha to shut his late father’s authorized apply. That is when he was launched to the then-29-year-old Buffett by one in every of Buffett’s investor purchasers. The 2 hit it off and stayed involved regardless of residing half a continent away from one another.

“We predict a lot alike that it is spooky,” Buffett recalled in an interview with the Omaha World-Herald in 1977. “He is as good and as high-grade a man as I’ve ever run into.”

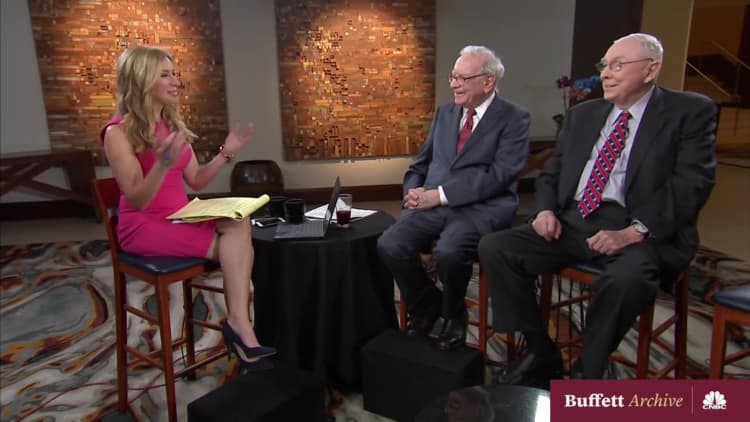

“We by no means had an argument in the complete time we have identified one another, which is sort of 60 years now,” Buffett advised CNBC’s Becky Fast in 2018. “Charlie has given me the final word reward that an individual can provide to any individual else. He is made me a greater individual than I’d have in any other case been. … He is given me numerous good recommendation over time. … I’ve lived a greater life due to Charlie.”

The melding of the minds targeted on worth investing, through which shares are picked as a result of their worth seems to be undervalued primarily based on the corporate’s long-term fundamentals.

“All clever investing is worth investing — buying greater than you might be paying for,” Munger as soon as stated. “You will need to worth the enterprise to be able to worth the inventory.”

Warren Buffett (L), CEO of Berkshire Hathaway, and vice chairman Charlie Munger attend the 2019 annual shareholders assembly in Omaha, Nebraska, Might 3, 2019.

Johannes Eisele | AFP | Getty Photos

However in the course of the coronavirus outbreak in early 2020, when Berkshire suffered an enormous $50 billion loss within the first quarter, Munger and Buffett have been extra conservative than they have been in the course of the Nice Recession, once they invested in U.S. airways and financials like Financial institution of America and Goldman Sachs hit laborious by that downturn.

“Nicely, I’d say principally we’re just like the captain of a ship when the worst storm that is ever occurred comes,” Munger advised The Wall Road Journal in April 2020. “We simply wish to get via the storm, and we might moderately come out of it with an entire lot of liquidity. We’re not enjoying, ‘Oh goody, goody, the whole lot’s going to hell, let’s plunge 100% of the reserves’ [into buying businesses].”

The philanthropist/architect

Munger donated a whole lot of hundreds of thousands of {dollars} to instructional establishments, together with the College of Michigan, Stanford College and Harvard Regulation College, typically with the stipulation that the college settle for his constructing designs, regardless that he was not formally skilled as an architect.

At Los Angeles’ Harvard-Westlake prep faculty, the place Munger had been a board member for many years, he ensured that the ladies loos have been bigger than the boys room in the course of the development of the science middle within the Nineties.

“Any time you go to a soccer recreation or a operate there’s an enormous line outdoors the ladies’s rest room. Who does not know that they pee differently than the lads?” Munger advised The Wall Road Journal in 2019. “What sort of fool would make the lads’s rest room and the ladies’s rest room the identical measurement? The reply is, a standard architect!”

Munger and his spouse had three youngsters, daughters Wendy and Molly, and son Teddy, who died of leukemia at age 9. The Mungers divorced in 1953.

Two years later, he married Nancy Barry, whom he met on a blind date at a hen dinner restaurant. The couple had 4 youngsters, Charles Jr., Emilie, Barry and Philip. He additionally was the stepfather to her two different sons, William Harold Borthwick and David Borthwick. The Mungers, who have been married 54 years till her loss of life in 2010, contributed $43.5 million to Stanford College to assist construct the Munger Graduate Residence, which homes 600 regulation and graduate college students.

Requested by CNBC’s Fast in a February 2019 “Squawk Field” interview in regards to the secret to a protracted and pleased life, Munger stated the reply “is straightforward, as a result of it is so easy.”

“You do not have numerous envy, you do not have numerous resentment, you do not overspend your revenue, you keep cheerful despite your troubles. You cope with dependable folks and also you do what you are alleged to do. And all these easy guidelines work so properly to make your life higher. They usually’re so trite,” he stated.

“And staying cheerful … as a result of it is a clever factor to do. Is that so laborious? And might you be cheerful once you’re completely mired in deep hatred and resentment? In fact you’ll be able to’t. So why would you’re taking it on?”

— CNBC’s Yun Li contributed reporting.