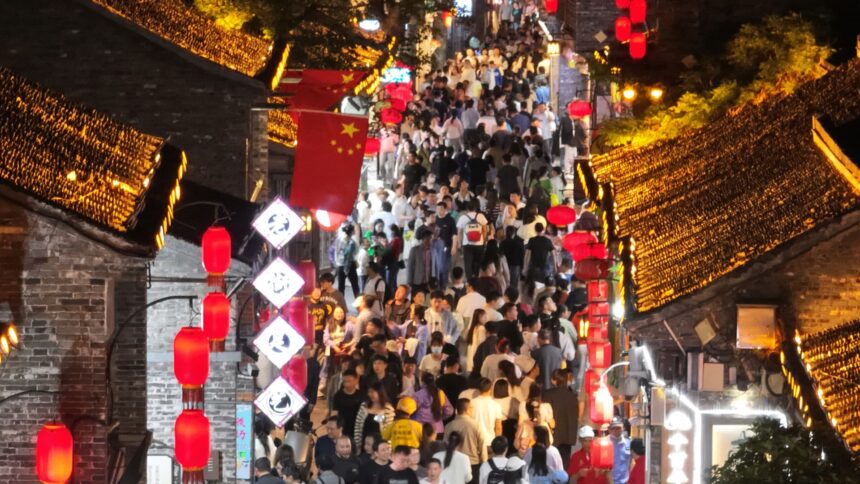

YANGZHOU, CHINA – MAY 02: Aerial view of vacationers visiting the Dongguan avenue throughout the Might Day vacation on Might 2, 2023.

Vcg | Visible China Group | Getty Photos

China’s financial information for April broadly missed expectations because the economic system continued to point out an uneven path of restoration from the affect of its stringent Covid restrictions.

Industrial manufacturing for April rose by 5.6% year-on-year, in comparison with the ten.9% anticipated by economists surveyed in a Reuters ballot. The determine was up 3.9% in March following a muted begin to the 12 months.

Retail gross sales rose by 18.4% – decrease than economists’ forecast a surge of 21%.

Fastened asset funding rose by 4.7%, in opposition to expectations of 5.5%. The studying rose 5.1% the earlier month.

“China is within the stage of recovering, in comparison with final 12 months, the numbers are constructive as we simply noticed, however is the restoration adequate for the market, is the restoration adequate to satisfy buyers’ expectations – that is the large query right here,” BofA Securities China fairness strategist Winnie Wu instructed CNBC’s “Avenue Indicators Asia.”

“It is not adequate to satisfy with buyers’ expectations – that is an issue,” Wu stated, including that the momentum from China’s pent-up demand appears to be fading away.

“The restoration of revenue, of job safety, and confidence will take time,” she stated.

“Market sentiment stays very weak in our shopper conversations,” Goldman Sachs economist Hui Shan wrote in a Sunday report.

She expects extra measures from the federal government somewhat than a change in rates of interest to enhance market confidence.

“Symbolic measures that intention at boosting confidence, similar to RRR cuts, appear extra more likely to us, particularly round quarter-end when liquidity demand is excessive,” she wrote, referring to banks’ reserve requirement ratio — the quantity of funds banks want to carry as reserves.

Report-high youth unemployment

The most recent information included a 20.4% youth jobless fee, the unemployment fee between ages 16 and 24. The studying in April marked a document excessive.

“Many individuals, buyers see this as a number one indicator. If the youthful persons are unable to get jobs, do not have the revenue safety, the place is the boldness, the place is the consumption restoration coming from?” stated Wu.

She stated the query of confidence is resonated in weakened markets sentiment in addition to different high-frequency information, together with new dwelling gross sales.