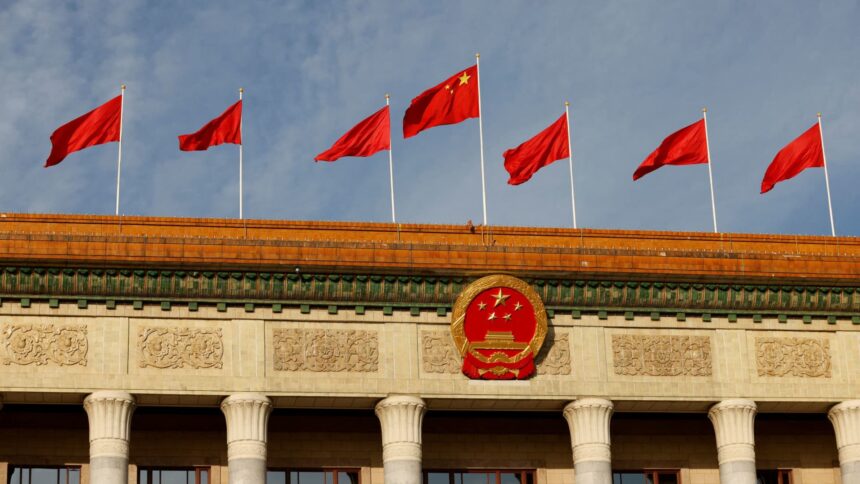

A Chinese language flag flutters on prime of the Nice Corridor of the Individuals forward of the opening ceremony of the Belt and Street Discussion board (BRF), to mark tenth anniversary of the Belt and Street Initiative, in Beijing, China October 18, 2023.

Edgar Su | Reuters

BEIJING — China is ready this week to kick off its annual parliamentary conferences, which buyers are watching carefully for indicators on financial stimulus.

The nation’s gross home product grew by 5.2% in 2023, however general restoration from the Covid-19 pandemic was slower than many had anticipated. A chronic hunch within the large actual property market and falling international demand for Chinese language exports have contributed to low ranges of shopper and enterprise sentiment.

That is all led to questions over whether or not Beijing will step in with large-scale help. To date, authorities have been comparatively reserved.

Beijing signaled in December that any new coverage help can be “applicable,” mentioned Wang Jun, chief economist at Huatai Asset Administration, including “there isn’t any method” that stimulus can be as giant because it was in 2008. That is in keeping with a CNBC translation of his Mandarin-language remarks.

China’s financial coverage is often set at an annual assembly in December by leaders inside the ruling Communist Social gathering of China.

The conferences this month, generally known as the “Two Periods,” are on the authorities, as a substitute of occasion, degree and sometimes launch extra particulars on coverage plans, such because the GDP goal for the 12 months.

Wang mentioned he’s looking forward to feedback on authorities’ plans for the true property sector, capital markets and native authorities funds.

Again in 2008, when the world was reeling from the monetary disaster, China unleashed a large stimulus bundle to maintain development with higher demand. Whereas the financial system rebounded, the measures drew criticism for a ensuing surge in native authorities debt.

Beijing in recent times has emphasised the necessity to stem monetary dangers and clamped down on actual property builders’ excessive reliance on debt for development, a problem tied to native authorities funds. This time round, China’s financial coverage additionally faces constraints on how far it might probably deviate from the U.S. Federal Reserve’s rate of interest path.

GDP and different financial targets

The Chinese language Individuals’s Political Consultative Convention, an advisory physique, is ready to kick off its annual assembly on Monday.

The next day the Nationwide Individuals’s Congress legislature is because of start its assembly. Tuesday can also be when the nation’s premier is predicted to share the 12 months’s targets for GDP, employment and different financial indicators in what’s referred to as the “Authorities Work Report.”

“The goal will doubtless stay comparatively excessive,” mentioned Financial institution of China’s chief researcher Zong Liang, noting GDP grew by 5.2% final 12 months. That is in keeping with a CNBC translation of his Mandarin-language remarks.

He expects the goal for the fiscal deficit might be round 3.5% and that financial coverage will even be comparatively unfastened.

China in October made a uncommon announcement that it was elevating the fiscal deficit to three.8%, from 3%.

“We anticipate the on-budget deficit – which excludes particular bonds, coverage financial institution bonds, and native authorities financing automobile (LGFV) debt – to be set at 3.0%-3.5% of GDP, narrowing from final 12 months’s 3.8% of GDP,” Louise Bathroom, lead economist at Oxford Economics, mentioned in a report Thursday.

“We anticipate a modest step-up within the native authorities particular bonds (LGSB) quota, to RMB4.0tn from RMB3.8tn final 12 months,” Bathroom mentioned. “Authorities may additionally lastly put pen to paper on the reported RMB1tn in deliberate central authorities particular bonds (CGSBs), reflecting the rising function of central coffers amid a continued debt cleanup course of amongst native authorities entities this 12 months.”

“On stability, the extra fiscal impulse this 12 months, assuming a bazooka-like fiscal bundle will not be forthcoming, is unlikely to be notably giant.”

Looking ahead to feedback on actual property and tech

The Two Periods can also be a interval for releasing the price range and for delegates to debate wanted coverage modifications and plans.

“Speeches by prime policymakers might be key to look at, together with interviews of key ministers, comparable to Minister of Trade and Data Know-how, Minister of Science and Know-how, and Minister of Housing and City-Rural Growth. These key ministers will talk about numerous insurance policies in additional element,” Goldman Sachs analysts mentioned in a report.

Throughout the parliamentary conferences, Chinese language officers will doubtless additionally talk about plans to bolster tech and innovation, according to a current high-level name to bolster “new productive forces.”

China’s overseas minister and premier sometimes maintain press conferences through the parliamentary conferences, which usually finish in mid-March. No dates have but been introduced.

Financial institution of China’s Zong expects that policymakers will ship indicators on opening up borders or different enterprise alternatives to foreigners, in addition to bettering the surroundings for non-state-owned enterprises.

Nonetheless, particular implementation particulars are sometimes left to particular person ministries to announce, following high-level directives from Beijing.

Any direct help for consumption is unlikely, however broader strikes to enhance the social security web can be of observe.

“On the demand aspect, the delayed Third Plenum [of the Chinese Communist Party’s Central Committee] (initially set for December) means that long run demand insurance policies – together with on fiscal, tax, and pensions reforms – should still be in preliminary phases of dialogue, however may nonetheless warrant a point out right here,” Bathroom mentioned.

The macro context

This 12 months’s Two Periods observe common management reshuffles which have strengthened the ruling Communist Social gathering of China’s management of the federal government.

On the parliamentary assembly final 12 months, Beijing introduced an overhaul of finance and tech regulation by establishing party-led commissions to supervise the 2 sectors. Chinese language President Xi Jinping, who can also be the occasion’s normal secretary, gained an unprecedented third time period as president.

No main Chinese language authorities or occasion management positions are scheduled to alter this 12 months, whereas the U.S. is ready to carry its presidential election in November.

Since final summer time, Chinese language authorities have already introduced a slew of insurance policies to bolster development and acknowledged the necessity to improve confidence. Critics say the measures are comparatively piecemeal.

Latest financial information releases level to a combined image for development, with some enchancment in manufacturing however actual property at finest solely stabilizing.

Huatai’s Wang expects the financial system will get well progressively this 12 months, and that in distinction to final 12 months, nominal GDP might be higher than actual GDP. Meaning the perceived enchancment this 12 months might be extra tangible for customers and companies.