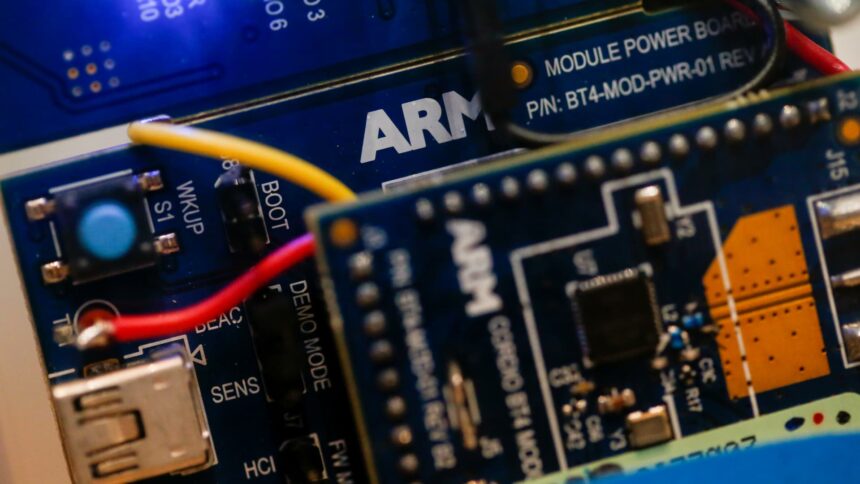

SoftBank CEO Masayoshi Son in opposition to a backdrop illustrating SoftBank Group and the Arm unit in 2016.

Bloomberg | Bloomberg | Getty Pictures

Chip design agency Arm on Tuesday mentioned it’s seeking to fetch as a lot as $4.87 billion in its upcoming blockbuster preliminary public providing on the New York Inventory Trade, based on a contemporary submitting.

The deal might worth the corporate at as a lot as $52 billion.

Arm submitted its up to date F-1 submitting with the U.S. Securities and Trade Fee, setting out its ambitions to as soon as once more develop into a publicly listed firm. It was beforehand dually listed in London and New York, earlier than SoftBank acquired it for $32 billion in 2016.

As a British firm, Arm qualifies as a international non-public issuer within the U.S. and its shares will rely as American depositary shares, or ADSs. The corporate will listing 95.5 million ADSs at a value vary between $47 and $51. On the higher finish of that vary, CNBC estimates that Arm will doubtless increase as much as $4.87 billion. On the decrease finish, the IPO would fetch $4.49 billion of contemporary capital for Arm.

When the corporate floats in New York, it’ll look to faucet right into a deep pool of institutional funds. Arm seeks to ramp up its investments in analysis and improvement, significantly because it pursues progress within the synthetic intelligence area with a few of its newer chips. The corporate not too long ago launched new chips particularly focused at AI and machine studying use instances.

On the higher finish of the pricing vary, Arm would additionally attain a complete valuation of $52 billion, based on CNBC calculations. On the decrease finish, its valuation would are available beneath $50 billion.

Solely 9.4% of Arm’s shares shall be freely traded on the New York Inventory Trade, with SoftBank anticipated to personal roughly 90.6% of the corporate’s excellent shares after the completion of the IPO.

The underwriters for the itemizing have an choice to buy as much as an extra 7 million American depositary shares, value $735 million. In the event that they select to buy these shares, SoftBank’s possession of Arm shall be decreased to 89.9%, the corporate mentioned.

Greatest tech IPO of the yr

Arm’s itemizing is ready to be the most important know-how IPO of the yr. Buyers are hoping that the itemizing might breathe new life into an IPO market that has largely been frozen over since 2022.

An onset of macroeconomic and geopolitical challenges — from Russia’s invasion of Ukraine to central financial institution rate of interest hikes — led to an enormous stoop in tech valuations final yr, which in flip brought on know-how companies to row again on choices to listing.

Arm sees enormous potential income alternative for its know-how, which it mentioned in its IPO submitting had a complete addressable market (TAM) of $202.5 billion in 2022. The agency sees this rising to $246.6 billion by the tip of the calendar yr ending on Dec. 31, 2025 — representing a compound annual progress price of 6.8%.

Arm says its energy-efficient processor designs and software program platforms are built-in into greater than 250 billion chips globally, into merchandise starting from sensors and smartphones to supercomputers.

The corporate estimates it instructions an roughly 48.9% share of the marketplace for semiconductor design. Different gamers, comparable to Intel and AMD, have raced to compensate for designing their very own chip architectures, however have struggled up to now.

The U.Ok. authorities had initially hoped Arm would listing on the London Inventory Trade, however the firm as an alternative dealt a significant blow to Britain’s ambitions to develop into the main international tech hub by choosing New York. The U.S. monetary middle has a deep institutional investor base and analysts who’ve an in depth understanding of the know-how sector.

Correction: This story has been amended to replicate the truth that Arm is itemizing on the Nasdaq inventory change in New York. A earlier model of this story misstated the identify of the change.