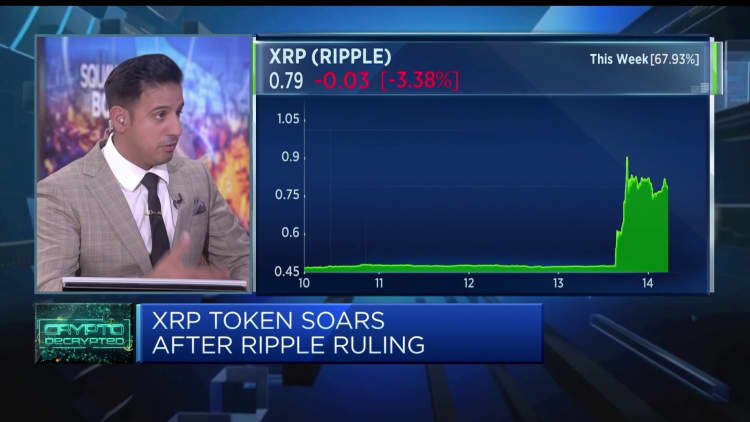

Coinbase’s arguments in its authorized case towards the U.S. Securities and Alternate Fee have been strengthened after a key court docket ruling went partially in favour of cryptocurrency agency Ripple, the U.S. alternate’s authorized chief instructed CNBC on Friday.

On Thursday, a U.S. choose dominated that XRP token purchases through exchanges weren’t securities transactions. The SEC sued Ripple, the corporate behind the XRP token, in 2020, alleging that the corporate broke securities legal guidelines.

associated investing information

The ruling was cheered by the cryptocurrency neighborhood and significantly by exchanges, which really feel the end result will assist create some extra regulatory readability.

One such alternate is Coinbase, which was sued in June by the SEC on fees of working an unregistered alternate and dealer.

However the newest XRP court docket opinion has given confidence to Coinbase in its case towards the SEC.

“For exchanges, for tokens which can be listed on exchanges, for normal traders, there is not any query that this ruling strikes a blow to the concept one way or the other securities are being traded when individuals go onto exchanges and commerce the belongings,” Paul Grewal, chief authorized officer at Coinbase, instructed CNBC in a TV interview on Friday.

“I feel we’ll win. Now, I believed we might win earlier than this determination. We expect this determination has solely additional strengthened the case,” he added.

A part of Coinbase’s optimism stems from the choice relating to XRP not being a safety. If XRP is not designated such, there may be hope that a whole bunch of different cryptocurrencies may even not be topic to safety legal guidelines.

“I feel it could be a mistake to imagine that, in each occasion, and in each transaction, the securities legal guidelines don’t apply. That is by no means been Coinbase’s place, I do not suppose it needs to be anybody’s cheap place. However for those who actually changed the letters XRP with the letters for some other token, on this determination, the logic nonetheless holds,” Grewal mentioned.

Nevertheless, one other a part of the judgement truly deemed it a securities transaction to promote XRP particularly to classy traders or institutional shoppers.

Coinbase has been attempting to develop its personal institutional buying and selling platform. Grewal shrugged off this a part of the case, as a result of it associated precisely to how Ripple offered XRP to institutional shoppers.

“I feel all traders, institutional and retail, can take nice consolation from the truth that, with regards to alternate buying and selling, the place there may be arm’s size dealing, the court docket has made it very clear, these tokens will not be being traded as securities,” Grewal mentioned.

SEC slammed

Whether or not or not cryptoassets are securities is a vital query with a number of implications. If they’re deemed securities, then they would want to register with the SEC and would have strict disclosure necessities. It might additionally give the SEC the ability to supervise these belongings and associated companies, corresponding to cryptocurrency exchanges.

The SEC has maintained that almost all cryptocurrencies are securities — however the determination on XRP appeared to weaken its argument.

The crypto business has had heated phrases for the SEC over the previous month, accusing the company of regulating by implementing, somewhat than by working with the business.

Pavlo Gonchar | Lightrocket | Getty Photos

Tyler Winklevoss, the co-founder of cryptocurrency alternate Gemini that can be topic to a SEC lawsuit, known as the regulator a “failed establishment.”

Coinbase’s Grewal mentioned he didn’t suppose the SEC was waging an ideological battle towards the cryptocurrency business, however that every one actions have been completed in “good religion.” Nevertheless, he added, “they have been improper.”

“What there was I feel, is a failure of management to comply with cheap engagement with the business and with different stakeholders, somewhat than resorting to court docket,” Grewal mentioned, calling for “new guidelines to cope with a brand new expertise.”