President of the European Central Financial institution (ECB) Christine Lagarde attends a session on the closing day of the World Financial Discussion board (WEF) annual assembly in Davos, on January 19, 2024.

Fabrice Coffrini | Afp | Getty Pictures

European Central Financial institution President Christine Lagarde stated she doesn’t anticipate a return to financial “normality” in 2024, regardless of seeing a balancing of sure knowledge factors all through the final 12 months.

Talking on a Bloomberg panel on the World Financial Discussion board in Davos, Switzerland, Lagarde described the post-pandemic interval as “unusual, extraordinary and troublesome to research” and recognized three developments that started to normalize final 12 months: consumption, commerce and inflation.

The pandemic noticed spending fall and folks’s financial savings develop, whereas world commerce was additionally disrupted. In October 2022, euro zone inflation hit 10.6% however dropped off in 2023, coming in at 2.9% in December.

“In ’23 we’ve got seen the start of normalization,” she stated on Friday. “Whenever you have a look at consumption as an example, all over the world … consumption continues to be a driving power for development, however the tailwind that we had the advantages of, are step by step fading,” Lagarde stated. Consumption softened, she stated, as the roles market grew to become rather less tight and shoppers’ financial savings diminished.

Commerce, in the meantime, was disrupted by shoppers’ desire for getting providers over items in 2021 and 2022, Lagarde stated. “However it’s starting now to essentially choose up and in October, we had world commerce numbers that for the primary time in lots of months was up.”

The World Commerce Group (WTO) expects commerce to extend by 3.3% in 2024, per a forecast launched in October.

Lagarde additionally famous the broad fall in inflation in 2023. “All over the world, inflation is coming down, and we’ve got seen it in November [in] each headline inflation and core inflation,” she stated.

“So that is what I name the normalization that we’ve got noticed in ’23,” Lagarde stated on the panel, including considerably cryptically: “And possibly you will give me the ground one other time to speak about it how it’s not normality that we’re heading to.”

In December, the ECB opted to carry charges unchanged for the second time in a row, shifting its inflation outlook from “anticipated to stay too excessive for too lengthy” to expectations that it’ll “decline step by step over the course of subsequent 12 months.”

Talking on the identical panel, WTO Director Basic Ngozi Okonjo-Iweala agreed that the financial system is “possibly shifting in direction of normalization” however she described it as “not regular, as a result of commerce development continues to be trending beneath GDP development.”

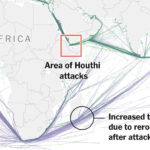

Okonjo-Iweala famous uncertainties that make forecasting “troublesome,” together with geopolitical conflicts, disruption within the Crimson Sea and elections all over the world.

A ‘new regular’

Germany’s Minister of Finance Christian Lindner characterised the present financial state of affairs as a “new regular.”

Talking on the identical WEF panel, he stated: “Seeking to what’s going to come over the following years, Christine [Lagarde] stated OK, we’re within the strategy of normalization. I might say we’re witnessing a brand new regular and 2023 marks this new regular.”

“Take into consideration the race of synthetic intelligence … take into consideration the geopolitical pressure and the specter of fragmentation we should cope with over the following years. The upper debt ranges after the pandemic and the power worth hikes, which has shrunk our fiscal area to finance transformation, and given … little or no development perspective of the worldwide financial system,” Lindner added.

“Has 2023 given me hope? … I might put it this fashion: It was a name for motion as a result of we’ve got to rearrange some insurance policies and … most likely we’re in the beginning of an period of latest structural reforms,” he stated.

Germany’s financial system — Europe’s largest — contracted 0.3% year-over-year in 2023, its Federal Statistical Workplace stated Monday. The workplace stated that the German financial system stagnated within the third quarter, implying the nation has narrowly prevented a technical recession.

— CNBC’s Ruxandra Iordache and Jenni Reid contributed to this report.