Merchants work on the ground of the New York Inventory Trade throughout morning buying and selling on February 29, 2024 in New York Metropolis.

Michael M. Santiago | Getty Photos

A brand new day, a brand new all-time excessive. From shares to bitcoin, asset courses throughout the board have been hitting uncharted territories.

Why?

There are just a few causes at play.

Unabating synthetic intelligence hype, hopes that world rates of interest could fall, and extra particular to the crypto area: bitcoin ETF approvals.

A fiery rally in tech shares powered the Nasdaq 100 to a recent file and helped the S&P 500 end above the 5,000 mark for the primary time ever final week. AI ecstasy has additionally boosted particular person tech shares to historic ranges, with Nvidia‘s inventory market worth smashing a $2 trillion valuation for the primary time ever.

Since these peaks nevertheless, Wall Avenue equities have pulled again as borrowing charge uncertainty weighs on buyers’ minds.

In Asia, Japan’s Nikkei 225 has echoed an eye-popping efficiency with the nation’s inventory market index newly crossing 40,000 factors on Monday. That is after the Nikkei zoomed previous 1989 highs final month – with the features largely pushed by sturdy earnings and company governance reforms.

Over within the different asset world, a mixture of buyers pouring cash into U.S. spot exchange-traded crypto merchandise, and bitcoin’s upcoming halving occasion supercharged the world’s largest cryptocurrency above $69,000 — a worth degree not seen in additional than two years.

Stellar costs for gold have additionally stolen investor consideration, with the valuable steel scaling a brand new file of over $2,100. The features have been fueled by U.S. charge reduce expectations and China financial woes, with gold historically rallying in occasions of financial stress.

The record-breaking numbers for markets, nevertheless, have not stopped some buyers from worrying about three key points.

Inflation resurgence

After months of cooling, U.S inflation is proving itself to be extra cussed than consultants had predicted.

Nobel laureate Paul Krugman flagged inflationary pressures within the U.S. in a latest publish on X, the place he constructed on Moody’s economist Mark Zandi’s ideas over a rise in core PCE (private consumption expenditures) deflator numbers.

“Enterprise surveys preserve failing to point out an inflation surge. These January numbers appear to be a blip ‘juiced by problematic seasonals’, as Mark Zandi places it,” Krugman mentioned.

Economist Nouriel Roubini, usually known as “Dr. Doom,” additionally chimed in on the subject, saying a Trump reelection might spell bother for the worldwide financial system, given his insurance policies might stoke inflation once more and should even set off stagflation.

JPMorgan’s chief market strategist constructed on dangers of stagflation too. Marko Kolanovic warned a “second inflation wave” might take maintain, with the probabilities of the “narrative turning again from goldilocks in direction of one thing like Nineteen Seventies stagflation,” he mentioned in a latest analysis observe. A goldilocks financial system refers to a good atmosphere whether or not knowledge is neither too scorching or chilly.

Monetary instability

An information-obsessed Fed can be on the concern playing cards for monetary buyers.

Prime economist and Allianz advisor Mohamed El-Erian mentioned in a Bloomberg op-ed {that a} Fed “held hostage” by knowledge might set off monetary instability.

“Do not get me mistaken; high-frequency inputs are necessary in any evaluation of financial situations and coverage responses,” El-Erian mentioned.

“In at the moment’s financial system, an extreme deal with the numbers ideas the steadiness of dangers towards holding rates of interest too restrictive for too lengthy, unduly rising the likelihood of output loss, greater unemployment and monetary instability,” he added.

El-Erian has long-been important of the Fed, blaming it for mischaracterizing inflation as a transitory downside in addition to being too late in its struggle towards shopper worth pressures.

Chatting with CNBC, El-Erian mentioned if the Fed does not reduce charges this yr, then “the market is appropriate to fret about financial progress and earnings.”

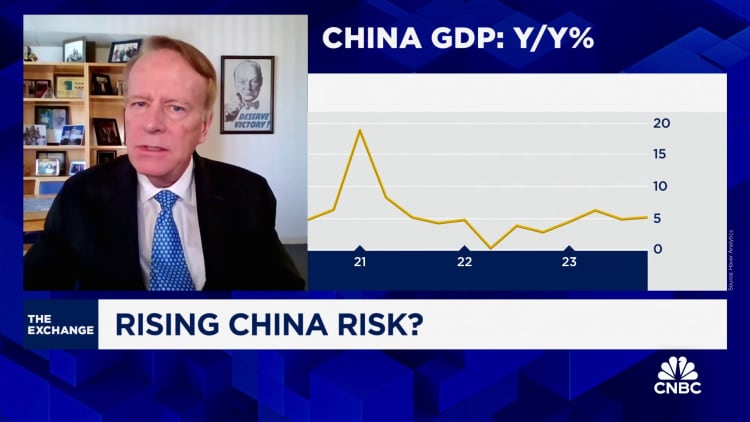

China woes

Troubles on the earth’s second-largest financial system have additionally gripped buyers. The nation is blistered with financial points, from a property disaster to deflationary pressures — and market watchers are nervous these woes might spill over to the remainder of the world.

Ariel Investments’ Vice Chair Charlie Bobrinskoy informed CNBC markets aren’t targeted on China’s residential actual property issues. “The market does perceive there’s a downside, however does not perceive the dimensions of the issue,” he mentioned, discussing the ripple results of the nation’s property market on the remainder of the world.

The auto trade has already begun seeing the consequences of a China slowdown of their earnings outcomes.

Tesla in addition to Chinese language carmaker BYD reported a 19% and almost 40% year-on-year plunge in China gross sales, respectively, in February.

File highs or not, it appears market consultants cannot be swayed to the upside simply but.