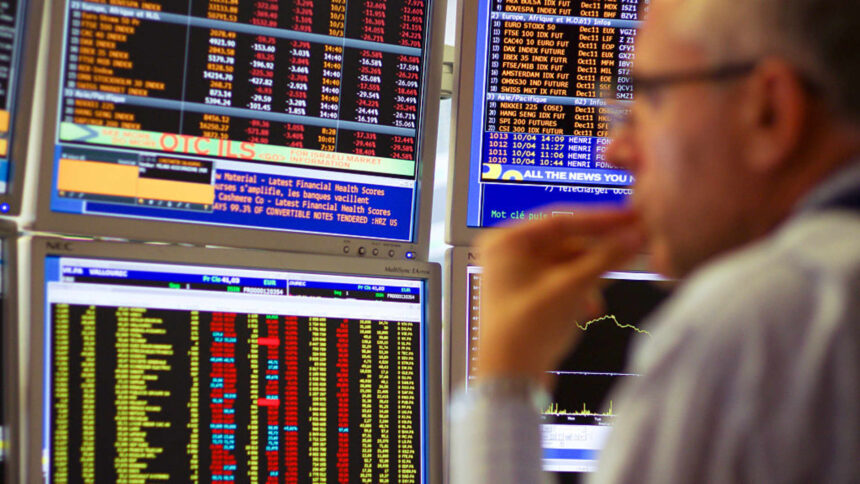

LONDON – European indexes are set to begin the buying and selling week on a stronger footing, with merchants waiting for extra company earnings, financial information and a Financial institution of England price resolution this week.

The U.Ok.’s FTSE 100 can be closed Monday for a public vacation after the coronation of King Charles III. France’s CAC 40 is about to begin the day 30 factors larger at 7,367, the German DAX is predicted to rise 58 factors to fifteen,791 and the Italian FTSE MIB is about to maneuver 115 factors larger to 26,575.

Market gamers have spent weeks juggling considerations over inflation and rates of interest, with the Financial institution of England due for a rate-setting assembly on Thursday. Each the Federal Reserve and the European Central Financial institution hiked charges by 1 / 4 of a proportion level final week, with many now anticipating the previous to begin chopping charges in some unspecified time in the future in the course of the summer time.

Asia-Pacific markets largely rose on Monday, with the one outlier being Japan, which noticed the Nikkei 225 fall. Minutes from Japan’s March financial coverage assembly confirmed board members have been involved over inflation accelerating at a higher-than-expected tempo.

U.S. futures have been flat on Monday as investor consideration this week turns to April’s shopper worth index due out Wednesday, adopted by the producer worth index on Thursday.

—CNBC’s Jihye Lee and Samantha Subin contributed to this text.

![Exclusive Interview: “[Ukraine’s] Sacrifices Are Our Sacrifices”](https://gettoknowafrica.org/wp-content/uploads/2023/05/Exclusive-Interview-Ukraines-Sacrifices-Are-Our-Sacrifices-150x150.jpeg)