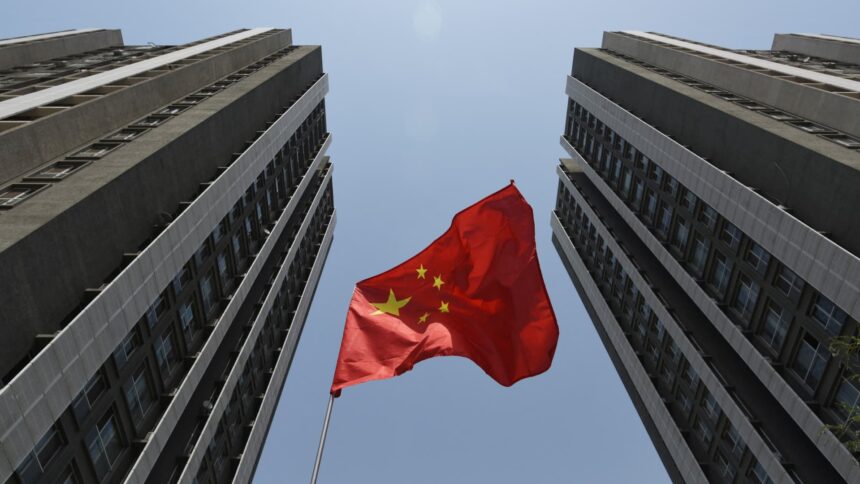

China might have bother attracting buyers once more this 12 months.

ETF Motion’s Mike Akins sees challenges tied to the nation’s skill to generate inventory market returns.

“It is form of the previous cliché. Idiot me as soon as, disgrace on you. Idiot me twice, disgrace on me,” the agency’s founding companion advised CNBC’s ETF Edge this week. “You’ve got obtained this case the place China’s financial system expanded. The inventory market went nowhere. It has been very risky. There’s been durations the place it is gone approach up but in addition come approach down.”

In accordance with Atkins, rising market ex-China merchandise are among the many largest inflows ETF Motion is seeing.

“You’ve got obtained an entire new problem that it’s important to take into consideration when going to that market,” he stated. “Is it investible from a standpoint of whole return? Or is it actually a progress story within the financial system alone and never within the precise return of the inventory market?”

Franklin Templeton Investments’ David Mann cites one other problem for investor hesitancy.

“The geopolitical issue with China is actually on everybody’s thoughts,” stated Mann, the agency’s international head of product and capital markets. “China was down final 12 months. It’s down once more this 12 months. Traders are most likely trying loads on the political aspect.”

The Cling Seng Index is down greater than 6% this 12 months and nearly 30% over the previous 52 weeks.