Nvidia inventory closed up 1% on Tuesday after CEO Jensen Huang stated in an analyst assembly that the corporate expects to extend its share of the $250 billion knowledge middle market.

Huang’s feedback had been made a day after Nvidia introduced its newest technology of synthetic intelligence chips, referred to as Blackwell, and a brand new AI software program platform.

“You’ll be able to construct chips to make software program run higher, however you possibly can’t create a brand new market with out software program. What makes us distinctive is that we’re the one chip firm I consider that can create its personal market,” he stated throughout the assembly on Tuesday.

Shares had dipped about 2% earlier than his feedback despatched the inventory again up.

Huang introduced the brand new chips on Monday at Nvidia’s developer convention in San Jose, California, touting them as much more highly effective processors than the present technology of Hopper graphics processing models, which have been extremely wanted for operating giant AI fashions. The primary Blackwell chip is the GB200 and can ship later this 12 months.

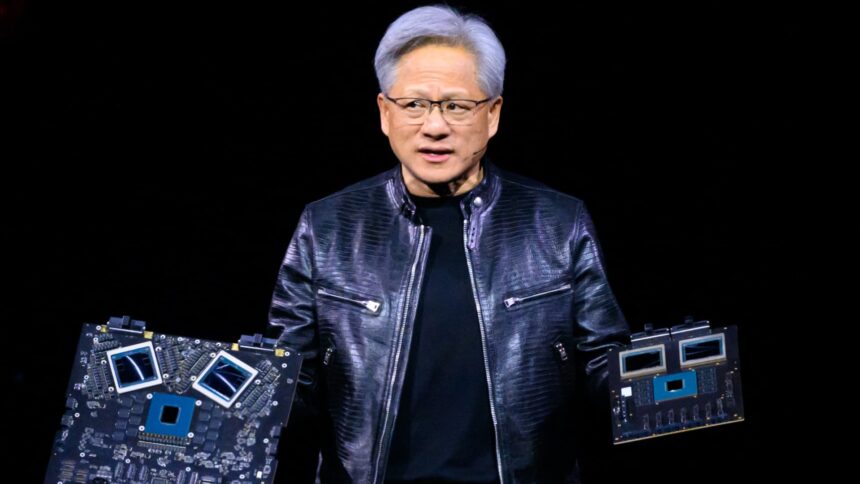

“We needed to invent some new know-how to make it doable,” stated Huang, holding up one of many new chips throughout an interview with CNBC’s “Squawk on the Road” on Tuesday. He estimated one chip might price $30,000 to $40,000 and that the analysis and growth finances for the processor totaled round $10 billion.

The corporate on Monday additionally introduced a brand new enterprise software program product referred to as Nvidia Inference Microservice, which makes it simpler to run older generations of Nvidia GPUs.

“Transfer over Taylor Swift, you are not the one one that may promote out a stadium as Jensen introduced his GTC keynote to a packed crowd on the SAP Middle in San Jose,” Bernstein analysts wrote in an investor observe Tuesday, sustaining an outperform score and $1,000 worth goal on the inventory.

Wells Fargo analysts reacted to the chipmaker’s announcement with measured optimism, reiterating their chubby score on Nvidia shares whereas boosting their worth goal to $970 from $840.

“Whereas NVDA as soon as once more highlighted its full stack / platform differentiation, we predict some could have anticipated a bit extra out of the Blackwell B200 launch,” the analysts wrote in a observe.

Nonetheless, the Wells Fargo analysts wrote the information strengthened their “long-standing optimistic thesis” on Nvidia’s know-how and monetization alternatives.

Analysts at Goldman Sachs, retaining a purchase score of Nvidia inventory, raised their worth goal to $1,000 from $875 on Tuesday and expressed “renewed appreciation” for Nvidia’s innovation, buyer and associate relationships, and pivotal position within the generative AI area following the corporate’s keynote.

“Primarily based on our current trade conversations, we count on Blackwell to be the quickest ramping product in Nvidia’s historical past,” the analysts wrote in a observe to traders. “Nvidia has performed (and can proceed to play) an instrumental position in democratizing AI throughout many trade verticals.”

— CNBC’s Michael Bloom contributed to this report.