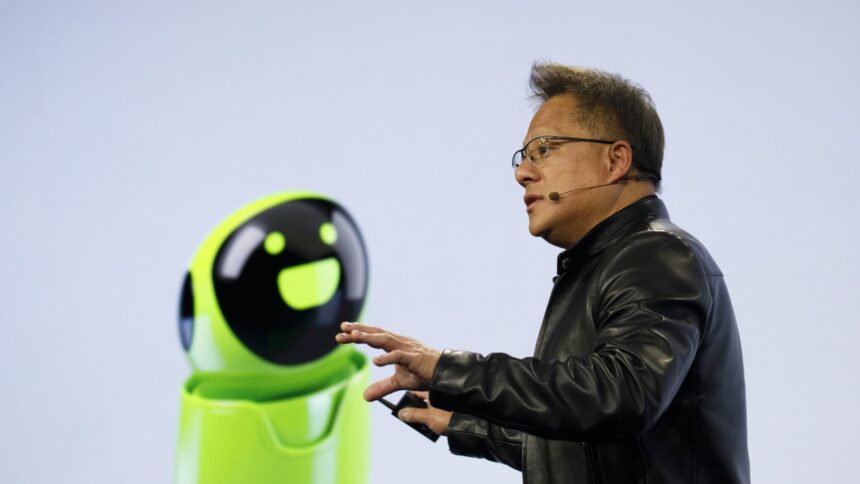

Jen-Hsun Huang, president and chief govt officer of Nvidia Corp., speaks through the firm’s occasion at Cell World Congress Americas in Los Angeles, California, U.S., on Monday, Oct. 21, 2019.

Patrick T. Fallon | Bloomberg | Getty Photos

So long as corporations are enthusiastic about generative synthetic intelligence, Nvidia stands to learn.

Nvidia shares closed up greater than 7% Monday, underscoring how traders imagine the corporate’s graphics processing items (GPUs) will proceed to be the most well-liked laptop chips used to energy large, giant language fashions that may generate compelling textual content.

Morgan Stanley launched an analyst word on Monday reiterating that Nvidia continues to be a “High Decide” coming off the corporate’s most up-to-date earnings report, wherein it provided a better-than-expected forecast.

“We expect the current selloff is an effective entry level, as regardless of provide constraints, we nonetheless anticipate a significant beat and lift quarter — and, extra importantly, robust visibility over the following 3-4 quarters,” the Morgan Stanley analysts wrote. “Nvidia stays our High Decide, with a backdrop of the large shift in spending in the direction of AI, and a reasonably distinctive provide demand imbalance that ought to persist for the following a number of quarters; we predict the current selloff is an effective entry level.”

Nvidia, now valued at over $1 trillion, bested all different corporations throughout this yr’s tech rebound following a market stoop in 2022, with the chip large’s shares up almost 200% to this point in 2023.

Though Nvidia shares dropped a bit of over 10% this month, partly attributed to produce constraints and ongoing issues over the broader financial system and whether or not it’s going to expertise a major rebound, the Morgan Stanley analysts predict that Nvidia will profit in the long term.

“The underside line is that it is a very constructive scenario, October numbers are solely gated by provide, and the higher finish of the purchase aspect consensus has been reined in,” the analysts wrote. “We see numbers are going up a minimum of sufficient that this inventory will commerce at P/Es extra much like the higher finish of semis, with materials upside nonetheless forward.”

Nvidia’s inventory has tripled this yr. The corporate will announce second-quarter outcomes on Aug. 23.