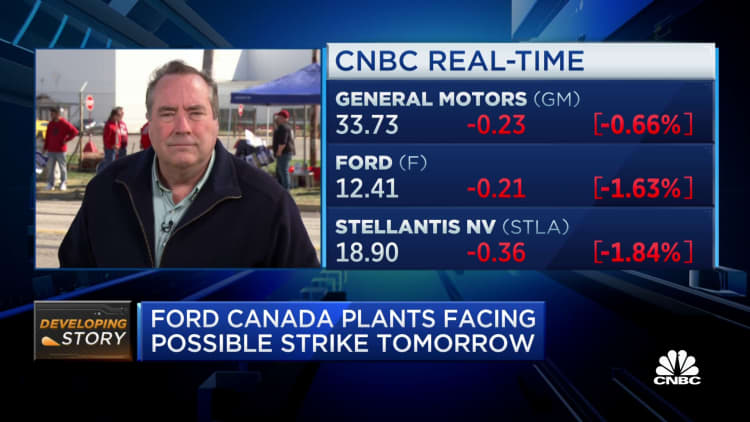

The auto staff’ strike is the most recent in a collection of labor-management conflicts that economists say may begin having vital progress impacts in the event that they persist.

Up to now, the United Auto Employees stoppage has impacted only a small portion of the workforce with restricted implications for the broader financial system.

However it’s a part of a sample in labor-management conflicts that has resulted in essentially the most missed hours of labor in some 23 years, based on Labor Division statistics.

“The rapid affect of the auto staff strike shall be restricted, however that can change if the strike broadens and is extended,” Ian Shepherdson, chief economist at Pantheon Macroeconomics, mentioned in a consumer observe Monday.

United Auto Employees (UAW) members on a picket line outdoors the Stellantis NV Toledo Meeting Complicated in Toldeo, Ohio, on Monday, Sept. 18, 2023.

Emily Elconin | Bloomberg | Getty Photos

The UAW has taken a considerably novel method to this walkout, focusing on simply three factories and involving lower than one-tenth of the employees on the Large Three automakers’ membership. Nonetheless, if issues warmth up and it turns into an all-out strike, bringing into play the 146,000 union members at Ford, GM and Stellantis, that would change issues.

In that case, Shepherdson sees a possible 1.7 proportion level quarterly hit to GDP at a time when many economists nonetheless worry the U.S. may tip into recession within the coming months. Auto manufacturing quantities to 2.9% of GDP.

A broader strike additionally would complicate policymaking for the Federal Reserve, which is making an attempt to convey down inflation with out tipping the financial system into contraction.

“The issue for the Fed is that it might be not possible to know in actual time how a lot of any slowing in financial progress may confidently be pinned on the strike, and the way a lot may very well be as a consequence of different elements, notably the hit to consumption from the restart of pupil mortgage funds,” Shepherdson mentioned.

Labor hours misplaced

American workplaces have taken a considerable hit from strikes this 12 months.

August alone noticed some 4.1 million labor hours misplaced this 12 months, essentially the most for a single month since August 2000, based on the Labor Division. Mixed with July, there have been almost 6.4 million hours misplaced from 20 stoppages. Yr so far, there have been 7.4 million hours misplaced, in comparison with simply 636 hours whole for a similar interval in 2022.

These large numbers have been the results of 20 massive stoppages which have included the Writers Guild of America and Display screen Actors Guild, state staff on the College of Michigan and resort staff in Los Angeles. Some 60,000 well being care staff in California, Oregon and Washington are threatening to stroll out subsequent.

After years of being comparatively quiescent, unions have discovered a louder voice within the high-inflation period of the previous a number of years.

“If you happen to’re a company CEO and you are not anticipating labor calls for, you are not tethered to actuality,” Joseph Brusuelas, chief economist at RSM, mentioned in an interview. “After the inflation shock we have gone by way of, staff are going to demand more cash, given the … probability that they’ve misplaced floor throughout this era of inflation. They will ask for more cash, and they’ll ask for office flexibility.”

Certainly, latest New York Fed information has proven that staff on common are asking for salaries near $80,000 a 12 months when switching jobs.

Within the UAW’s case, the union has requested for demanded a 36% elevate unfold over 4 years, just like the pay good points that automaker CEOs have seen.

Inflation impacts

However Brusuelas mentioned that potential 9% annual UAW will increase should not have a serious affect on macroeconomic situations, together with inflation.

Unions have made up a progressively smaller share of the workforce, declining to a document low 10.1% in 2022, about half the place it was 40 years in the past, based on the Labor Division. Simply 6% of personal sector staff are unionized, whereas 33% of presidency staff are organized.

“Labor strife goes to have a comparatively small impact on the general macro financial system,” Brusuelas mentioned. “This is not that large of a deal and it should not come as a shock following such a steep improve in inflation.”

Biden administration officers additionally will not be sounding any alarms but concerning the potential financial affect.

Within the rapid time period, the stoppage will not present up within the September jobs numbers, at a time when payroll progress is decelerating.

“I believe it is untimely to be making forecasts about what it means for the financial system,” Treasury Secretary Janet Yellen instructed CNBC’s Sara Eisen in an interview aired Monday. “It will rely very a lot on how lengthy the strike lasts and precisely who’s affected by it. However the necessary level, I believe, is that the 2 sides have to slim their disagreements and to work for a win-win.”