A model of this story first appeared in CNN Enterprise’ Earlier than the Bell e-newsletter. Not a subscriber? You may join proper right here. You may hearken to an audio model of the e-newsletter by clicking the identical hyperlink.

New York

CNN

—

In an uncommon coincidence, the US jobs report was launched on a vacation Friday — which means inventory markets have been closed when the closely-watched financial knowledge got here out.

It was the primary month-to-month payroll report since Silicon Valley Financial institution and Signature Financial institution collapsed. It additionally marked a full yr of jobs knowledge for the reason that Federal Reserve started mountaineering rates of interest in March 2022.

Whereas inflation has come down and different financial knowledge level to a cooling financial system, the labor market has remained remarkably resilient.

Traders have had an extended weekend to chew over the small print of the report and can possible skip the standard gut-reaction to headline numbers.

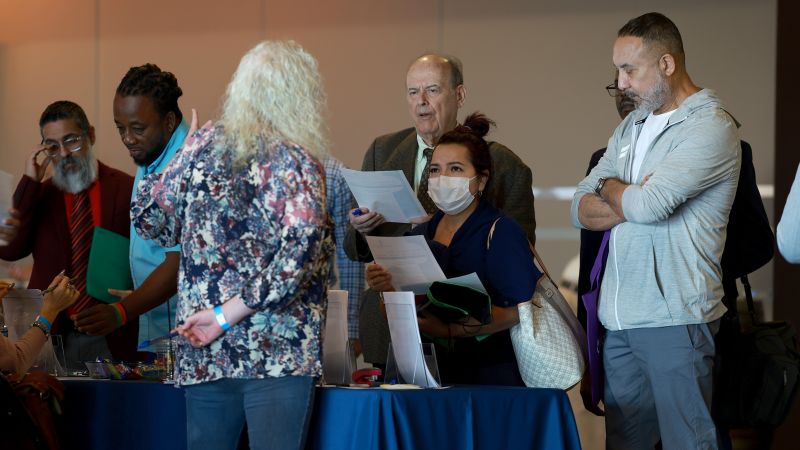

What occurred: The US financial system added 236,000 jobs in March, exhibiting that hiring remained sturdy although the tempo was slower than in earlier months. The unemployment charge at the moment stands at 3.5%.

Wages elevated by 0.3% on the month and 4.2% from a yr in the past. The three-month wage development common has dropped to three.8%. That’s transferring nearer to what Fed policymakers “imagine to be according to secure wage and inflation expectations,” wrote Joseph Brusuelas, chief economist at RSM in a be aware.

“That wage knowledge tends to recommend that the danger of a wage worth spiral is easing and that can create house within the close to time period for the Federal Reserve to interact in a strategic pause in its efforts to revive worth stability,” he added.

The March jobs report was the final earlier than the Fed’s subsequent coverage assembly and announcement in early Could. The labor market is cooling however not quickly or considerably, and additional charge hikes can’t be dominated out.

On the identical time Wall Road is starting to see unhealthy information as unhealthy information. A slowing financial system might imply a recession is forthcoming.

Markets are nonetheless largely anticipating the Fed to boost charges by one other quarter level. So how will they react to Friday’s report?

Earlier than the Bell spoke with Michael Arone, State Road World Advisors chief funding strategist, to search out out.

This interview has been edited for size and readability.

Earlier than the Bell: How do you count on markets to react to this report on Monday?

Michael Arone: I believe that this has been a pleasant counterbalance to the weaker labor knowledge earlier final week and all of the recession fears. This knowledge means that the financial system remains to be in fairly fine condition, 10-year Treasury yields elevated on Friday indicating there’s much less worry about an imminent recession.

There’s this delicate stability between slower job development and a weaker labor market with out financial devastation. I believe this report helps that.

Because it pertains to the inventory market, I’d count on the cyclical sectors to do nicely — your industrials, your supplies, your power corporations. If rates of interest are rising, that’s going to weigh on development shares — expertise and communication companies sectors, for instance. Much less recession fears will imply buyers gained’t be as defensively positioned in basic staples like healthcare and utilities.

May this result in a reverse within the present development the place tech corporations are bolstering markets?

Sure, precisely. It’s tough to make an excessive amount of out of any singular knowledge level, however I believe this report will hopefully result in broader participation within the inventory market. If these recession fears start to abate considerably, and buyers acknowledge that recession isn’t imminent, there will likely be extra funding.

What else are buyers on this report?

We’ve seen weak point within the rate of interest delicate elements of the market — areas which might be sometimes the primary to weaken because the financial system slows down. So issues like manufacturing, issues like building. That’s the place the weak point on this jobs report is. And the companies areas proceed to stay sturdy. That’s the place the scarcity of certified expert staff stays. I believe that you just’re seeing continued job energy in these areas.

What does this imply for this week’s inflation reviews? It looks like the roles report simply pushed the strain ahead.

it did. I count on that inflation figures will proceed to decelerate — or develop at a slower charge. However I do suppose that the sticky a part of inflation continues to be on the wage entrance. And so I believe, if something, this helps alleviate a few of these inflation pressures, however we’ll see the way it flows by into the CPI report subsequent week. And in addition the PPI report.

Is the Federal Reserve addressing actual structural modifications to the labor market?

The Fed was confused in February 2020 after we have been in full employment and there was no inflation. They’re equally confused at the moment, after elevating charges from zero to five%, that we haven’t had extra job losses.

I’m undecided why, however from my perspective, the Fed hasn’t considered the structural modifications within the labor pressure, and so they’re nonetheless confused by it. I believe the danger right here is that they’ll proceed to concentrate on elevating charges to stabilize costs, maybe underestimating the form of structural modifications within the labor financial system that haven’t resulted in the kind of weak point that they’ve been anticipating. I believe that’s a threat for the financial system and markets.

Just a few weeks in the past, Earlier than the Bell wrote about large issues brewing within the $20 trillion business actual property trade.

After a long time of thriving development bolstered by low rates of interest and simple credit score, business actual property has hit a wall. Workplace and retail property valuations have been falling for the reason that pandemic caused decrease occupancy charges and modifications in the place individuals work and the way they store. The Fed’s efforts to struggle inflation by elevating rates of interest have additionally harm the credit-dependent trade.

Current banking stress will possible add to these woes. Lending to business actual property builders and managers largely comes from small and mid-sized banks, the place the strain on liquidity has been most extreme. About 80% of all financial institution loans for business properties come from regional banks, in line with Goldman Sachs economists.

Since then, issues have gotten worse, CNN’s Julia Horowitz reviews.

In a worst-case situation, anxiousness about financial institution lending to business actual property might spiral, prompting clients to yank their deposits. A financial institution run is what toppled Silicon Valley Financial institution final month, roiling monetary markets and elevating fears of a recession.

“We’re watching it fairly carefully,” mentioned Michael Reynolds, vp of funding technique at Glenmede, a wealth supervisor. Whereas he doesn’t count on workplace loans to change into an issue for all banks, “one or two” establishments might discover themselves “caught offside.”

Indicators of pressure are growing. The proportion of business workplace mortgages the place debtors are behind with funds is rising, in line with Trepp, which offers knowledge on business actual property.

Excessive-profile defaults are making headlines. Earlier this yr, a landlord owned by asset supervisor PIMCO defaulted on almost $2 billion in debt for seven workplace buildings in San Francisco, New York Metropolis, Boston and Jersey Metropolis.

Dig into Julia’s story right here.

Tech shares led market losses in 2022, however appeared to rebound rapidly initially of this yr. In order we enter earnings season, what ought to we count on from Huge Tech?

Daniel Ives, an analyst at Wedbush Securities, says that he has excessive hopes.

“Tech shares have held up very nicely up to now in 2023 and comfortably outpaced the general market as we imagine the tech sector has change into the brand new ‘security commerce’ on this total unsure market,” he wrote in a be aware on Sunday night.

Even the latest spate of layoffs in Huge Tech has upside, he wrote.

“Vital value slicing underway within the Valley led by Meta, Microsoft, Amazon, Google and others, conservative steerage already given within the January earnings season ‘rip the band- assist off second’, and tech fundamentals which might be holding up in a shaky macro [environment] are organising for a inexperienced gentle for tech shares.”