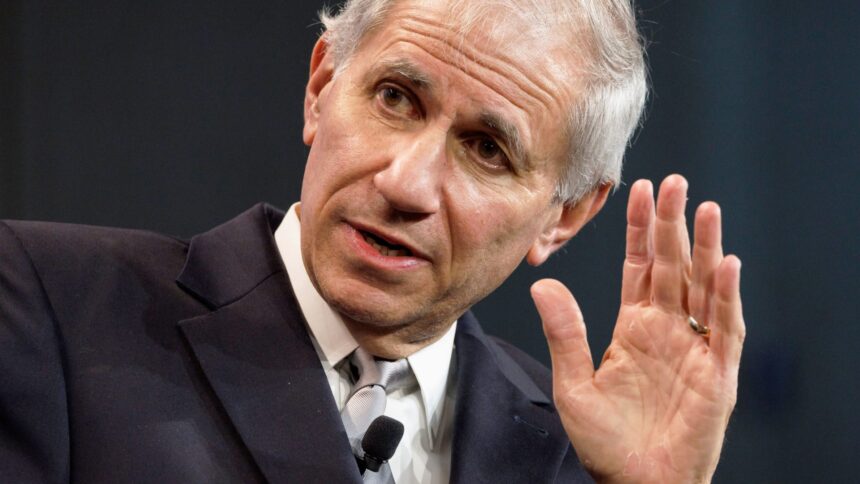

Martin Gruenberg, appearing chairman of the Federal Deposit Insurance coverage Corp. (FDIC), speaks throughout an City Institute panel dialogue in Washington, D.C., on Friday, June 3, 2022.

Ting Shen | Bloomberg | Getty Photographs

U.S. regulators on Tuesday unveiled plans to pressure regional banks to subject debt and bolster their so-called residing wills, steps meant to guard the general public within the occasion of extra failures.

American banks with at the very least $100 billion in property can be topic to the brand new necessities, which makes them maintain a layer of long-term debt to soak up losses within the occasion of a authorities seizure, in line with a joint discover from the Treasury Division, Workplace of the Comptroller of the Foreign money, Federal Reserve and Federal Deposit Insurance coverage Corp.

The steps are a part of regulators’ response to the regional banking disaster that flared up in March, in the end claiming three establishments and damaging the earnings energy of many others. In July, the businesses launched the primary salvo of anticipated modifications, a sweeping set of proposals meant to intensify capital necessities and standardize threat fashions for the trade.

Of their newest proposal, impacted lenders should keep long-term debt ranges equal to three.5% of common complete property or 6% of risk-weighted property, whichever is increased, in line with a reality sheet launched Tuesday by the FDIC. Banks shall be discouraged from holding the debt of different lenders to cut back contagion threat, the regulator stated.

Greater funding prices

The necessities will create “reasonably increased funding prices” for regional banks, the businesses acknowledged. That might add to the trade’s earnings stress in spite of everything three main rankings businesses have downgraded the credit score rankings of some lenders this 12 months.

Nonetheless, the trade could have three years to evolve to the brand new rule as soon as enacted, and plenty of banks already maintain acceptable types of debt, in line with the regulators. They estimated that regional banks have already got roughly 75% of the debt they’ll in the end want to carry.

The KBW Regional Banking Index, which has suffered deep losses this 12 months, rose lower than 1%.

Certainly, trade observers had anticipated these newest modifications: FDIC Chairman Martin Gruenberg telegraphed his intentions earlier this month in a speech on the Brookings Establishment.

Medium is the brand new large

Broadly, the proposal takes measures that apply to the most important establishments — recognized within the trade as world systemically vital banks, or GSIBs — right down to the extent of banks with at the very least $100 billion in property. The strikes had been broadly anticipated after the sudden collapse of Silicon Valley Financial institution in March jolted prospects, regulators and executives, alerting them to rising dangers within the banking system.

That features steps to boost ranges of long-term debt held by banks, eradicating a loophole that allowed midsized banks to keep away from the popularity of declines in bond holdings, and forcing banks to provide you with extra sturdy residing wills, or decision plans that might take impact within the occasion of a failure, Gruenberg stated this month.

Regulators would additionally take a look at updating their very own steering on monitoring dangers together with excessive ranges of uninsured deposits, in addition to modifications to deposit insurance coverage pricing to discourage dangerous habits, Gruenberg stated within the Aug. 14 speech. The three banks seized by authorities this 12 months all had comparatively massive quantities of uninsured deposits, which had been a key issue of their failures.

What’s subsequent for regionals?

Analysts have centered on the debt necessities as a result of that’s the most impactful change for financial institution shareholders. The purpose of elevating debt ranges is in order that if regulators have to seize a midsized financial institution, there’s a layer of capital prepared to soak up losses earlier than uninsured depositors are threatened, in line with Gruenberg.

The transfer will pressure some lenders to both subject extra company bonds or change current funding sources with costlier types of long-term debt, Morgan Stanley analysts led by Manan Gosalia wrote in a analysis word Monday.

That may additional squeeze margins for midsized banks, that are already below stress due to rising funding prices. The group might see an annual hit to earnings of as a lot as 3.5%, in line with Gosalia.

There are 5 banks particularly which will want to boost a complete of roughly $12 billion in recent debt, in line with the analysts: Areas, M&T Financial institution, Residents Monetary, Northern Belief and Fifth Third Bancorp. The banks did not instantly reply to requests for remark.

Financial institution teams complain

Having long-term debt readily available ought to calm depositors throughout occasions of misery and reduces prices to the FDIC’s personal Deposit Insurance coverage Fund, Gruenberg stated this month. It additionally improves the probabilities {that a} weekend public sale of a financial institution could possibly be accomplished with out utilizing extraordinary powers reserved for systemic dangers, and provides regulators extra choices in that state of affairs, like changing possession or breaking apart banks to promote them in items, he stated.

“Whereas many regional banks have some excellent long-term debt, the brand new proposal will possible require issuance of recent debt,” Gruenberg stated. “Since this debt is long-term, it won’t be a supply of liquidity stress when issues develop into obvious. In contrast to uninsured depositors, traders on this debt know that they won’t be able to run when issues come up.”

Traders in long-term financial institution debt could have “higher incentive” to watch threat at lenders, and the publicly traded devices will “function a sign” of the market’s view of threat in these banks, he stated.

Regulators are accepting feedback on these proposals by the tip of November. Commerce teams raised howls of protest when regulators launched a part of their plans in July.

Correction: FDIC Chairman Martin Gruenberg gave a speech in August on the Brookings Establishment. An earlier model misstated the month.