Think about having a private security web, at all times able to catch you if life throws you a curveball. That’s what saving cash can do for you.

It’s like having a superpower that gives you with a way of calm, figuring out you’re coated if life decides to go off script.

With financial savings tucked away, you may breathe straightforward and dodge stress since you’re geared up to deal with sudden conditions with out getting right into a monetary bind.

Past Weathering Storms: Fulfilling Goals and Having fun with the Current

However the advantages of saving transcend simply weathering storms. Take into consideration your desires and your bucket record.

Need to personal a house sometime, drive your dream automobile, or retire comfortably? That’s the place your financial savings are available. It’s the gasoline that propels you towards your targets and provides you the means to pursue the issues that matter to you.

It’s not nearly you, although. With a strong financial savings account, you may make desires come true on your youngsters too, giving them a head begin of their schooling or enabling you to assist them reap the benefits of alternatives that come their means.

Saving isn’t solely about getting ready for wet days or dreaming of the longer term; it’s additionally about having fun with the current.

Whether or not you’re planning a trip or a family renovation, your financial savings could make it occur. And, ought to one thing sudden occur — like a well being disaster or job loss — a stable financial savings behavior can guarantee your loved ones is cared for.

Constructing an emergency fund ought to be on everybody’s to-do record as a result of it’s like an insurance coverage coverage for all times’s inevitable surprises.

Saving for Retirement: Decreasing Tax Burden and Fostering Altruism

Saving, particularly for retirement, can even cut back your tax burden. Most international locations provide incentives for investing in retirement autos, and plenty of employers additionally provide to match contributions as much as a sure threshold, offering extra incentives.

On the extra altruistic entrance, having a well-stocked financial savings account can empower you to assist associates, household, or causes you imagine in.

Saving Habits Across the World

Argentina – Weathering Financial Hurdles

Argentina has confronted quite a few financial hurdles within the final twenty years, together with financial institution runs, recessions, and foreign money devaluations. Excessive inflation makes budgeting a problem, and conventional saving mechanisms wrestle to outpace it. However, Argentineans held substantial quantities in financial savings accounts and time deposits.

France – Excessive Financial savings Charges and Notoriously Excessive Taxes

The French are identified for his or her excessive financial savings charges, with financial institution deposits being the most typical type of financial savings. France has notoriously excessive taxes, together with earnings tax, social safety tax, and Worth-Added Tax (VAT) on most items, which fund public advantages.

The US of America – Sluggish Restoration and Elevated Financial savings

The US economic system offers restricted authorities advantages in comparison with different developed nations. People fund their retirement through Social Safety and private financial savings, and so they have began saving extra after the gradual restoration from the Nice Recession.

South Africans’ Saving Habits

In South Africa, insufficient retirement provisions are a big concern, with an alarming variety of folks planning to proceed working attributable to an absence of retirement financial savings. Center-income South Africans closely relied on debt earlier than the worldwide Covid-19 pandemic.

Limitations to Saving in Africa

Low financial savings charges in Africa might be attributed to numerous elements, together with insufficient monetary companies, excessive minimal stability necessities, and restricted incentives to avoid wasting. Monetary literacy additionally performs a job within the low financial savings charges and excessive indebtedness.

The Position of AI in Encouraging Saving

The fintech area in Africa, together with South Africa, has seen important innovation not too long ago, providing options to conventional modes of saving. Open banking and synthetic intelligence (AI) have made inroads into private finance, offering data-driven saving recommendation.

AI’s potential to reinforce saving habits lies in its capacity to research patterns in complete monetary knowledge.

AI can look at a person’s earnings, spending, and saving habits, providing methods to optimize them.

AI saving assistants can execute transfers extra continuously, permitting for smaller but extra constant financial savings.

AI can even help in objective setting for important bills like a house or enterprise, serving to monetary establishments tailor their merchandise to satisfy buyer wants.

AI-Powered Monetary Companies: A Promising Future

Intuit’s machine studying fashions are adapting to help the rising gig economic system and distinctive monetary administration challenges confronted by freelancers.

AI-powered monetary companies have the potential to create customized suggestions and incentives that assist prospects meet their distinctive financial savings targets.

The long run for AI-powered monetary companies is promising, with the potential to not solely provide new, personalized companies to prospects but additionally to drive exploration into totally different functions for his or her merchandise.

AI could be a highly effective instrument to maximise financial savings and obtain monetary targets.

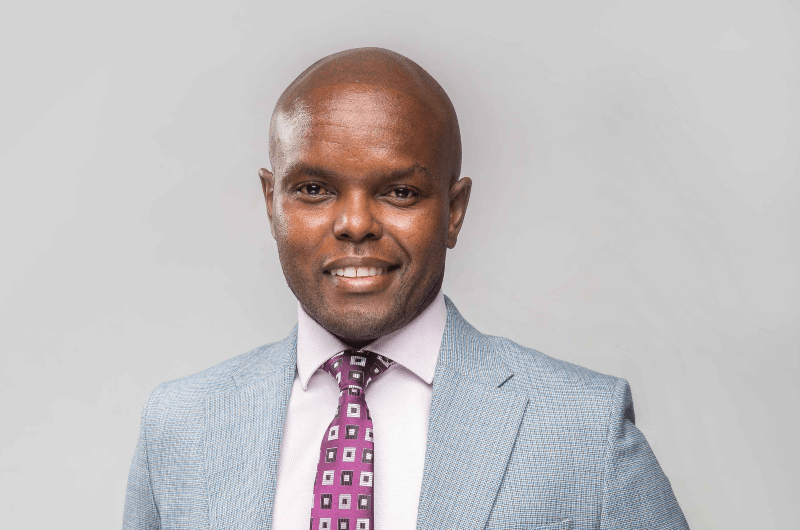

By Prof. Mark Nasila, Chief Knowledge and Analytics Officer in FNB Chief Danger Workplace