African communities have a wealthy historical past of revolutionary monetary collaboration, with practices like stokvels and funeral financial savings exemplifying the collective effort to pool assets for mutual profit. Nevertheless, these initiatives usually lack entry to correct banking and monetary providers, with many contributors missing financial institution accounts.

Komuniti, in collaboration with banking-as-a-service (BaaS) and embedded finance enabler Ukheshe, goals to alter this by introducing an app that facilitates stokvels, funeral donations, stokvel borrowings, and numerous different monetary services and products in South Africa.

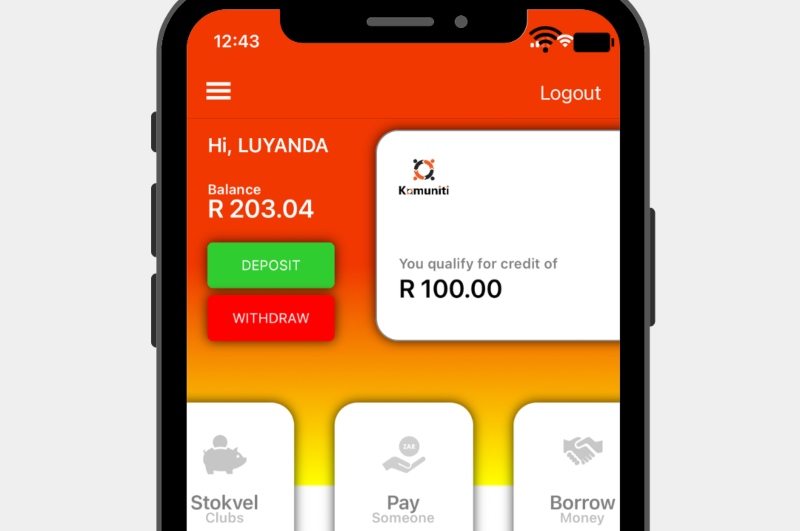

Komuniti is a neobank, a part of a brand new era of economic disruptors providing digital banking alternate options to conventional banks. It empowers customers with complete monetary options, serving to them handle their funds, help group causes, and obtain their monetary targets by way of a single app.

Neobanks like Komuniti leverage revolutionary expertise to offer reasonably priced, safe on-line monetary providers and remodel how folks handle their cash, particularly those that have been beforehand excluded from the digital economic system.

Komuniti addresses the hole within the banking market by providing on-line digital accounts, digital funds, stokvel financial savings, charitable donation instruments, on the spot borrowing, and handy deposit and withdrawal choices. It creates a digital monetary ecosystem that introduces different financial savings and earnings streams to these underserved by conventional banks.

In a world more and more pushed by digital applied sciences, conventional banking strategies usually fall brief in assembly numerous monetary wants, leaving a considerable portion of the African inhabitants unbanked or underserved.

Regardless of preliminary challenges, Komuniti acknowledged a chance to carry change to a ripe market. The corporate’s founders joined forces with Ukheshe, a collaboration facilitated by Mastercard, to allow Komuniti’s imaginative and prescient of offering inclusion within the digital world economic system for underserved communities.

Ukheshe performs a vital position on this collaboration, offering the mandatory framework for Komuniti to ship its banking providers successfully. The partnership aligns with Komuniti’s mission to empower people and communities by means of monetary inclusion.

Ukheshe’s Eclipse platform empowers innovators like Komuniti, enabling personalized monetary choices and regulatory compliance in a scalable method.

Komuniti and Ukheshe partnership democratizes finance, increasing digital economic system entry for underserved communities, and guaranteeing inclusion and development.